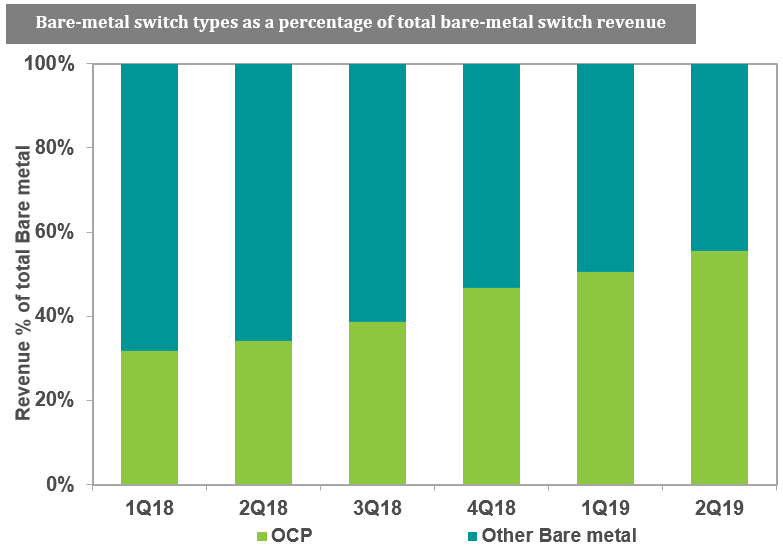

Commodity, bare-metal network switches for data centers are steadily gaining market share versus legacy networking equipment, while Open Compute Project-certified data center switches are gaining share within the bare-metal category.

More than half of the bare-metal switches sold to data center operators in the second quarter were OCP-certified, according to the latest numbers from analysts at IHS Markit | Technology, a DCK sister brand in the Informa Tech family. Overall, the analysts expect bare-metal switches to grow from 20 percent of the market last year to 34 percent in 2023.

Wanting to write their own software to manage their networks and not wanting to pay the exorbitant margins legacy vendors like Cisco and Juniper bake into their tightly integrated software-hardware networking solutions, hyperscale cloud platforms like Google, Facebook, and Microsoft years ago pushed the market toward disaggregating network software from network hardware.

Facebook and Microsoft have been doing it within the framework of OCP, the Facebook-founded open source data center hardware community.

For years, however, most OCP vendors focused solely on serving the needs of these large customers, making OCP gear difficult to access for smaller, enterprise data center operators. In addition, enterprises have been reluctant to leave the comfort of their full-support, tried and true legacy-vendor relationships and dive into the DIY-centered open source world.

But the trend appears to be changing. Last year’s Data Center Network Strategies North American Enterprise Survey by IHS found that the number of companies planning to use OCP-certified switches was expected to increase 14 percent from 2018 to 2019.

Vendors made $221 million in revenue from OCP-certified switch sales in the second quarter of this year, or double what it was a year ago, according to IHS. That’s 55 percent of all bare-metal data center switch revenue during the period. Bare metal switch revenue grew 32 percent in the second quarter.

Source: IHS Markit Technology

The analysts expect more vendors to introduce OCP switches and for growth to continue in this category.

IHS Markit Principal Analyst Devan Adams:

“The growth experienced by the bare-metal switch segment is due to several factors, including DC capex reduction directives, ramping software defined networking (SDN) deployments and rising adoption of merchant-based and programmable switch silicon. These same developments are bringing OCP-certified switches into the networking limelight and boosting their deployments in DC networks.”