Leading data center operators have been stepping up investment in technologies that make the experience of using their services more like the experience of using public cloud platforms like Amazon Web Services and Microsoft Azure.

QTS Realty has focused on this more than most companies in its space. While these investments can be a drag on earnings, the resulting additional value for customers should create long-term value for shareholders. Data center operators must innovate if they don’t want to simply compete on price, which is not a sustainable long-term strategy.

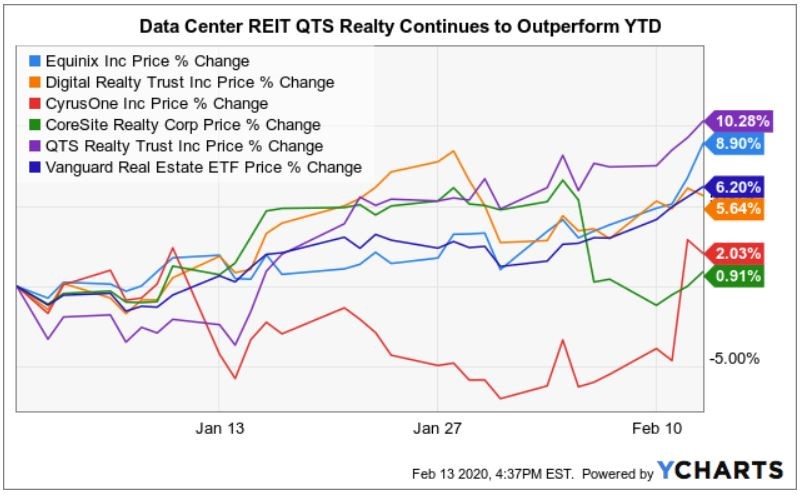

At a $3.5 billion market cap, QTS has been leading the sector in shareholder price appreciation so far this year. It is slightly ahead of the global interconnection giant Equinix, a $53 billion-cap S&P 500 company and the world’s largest data center provider by revenue.

Equinix also hasn’t been shy to invest in improving the interface between its customers and its networks and facilities. There is little doubt that the Equinix SDN-enabled ECX Fabric has contributed to investor confidence in future revenue and earnings growth.

Its most recent – and perhaps boldest – such investment came just earlier this year, when the company announced an agreement to acquire Packet, whose infrastructure-automation platform will enable Equinix to give customers the ability to provision bare-metal servers inside its data centers remotely.

Equinix and QTS outperformed their data center REIT peers (and REIT sector generally) last year, delivering share price appreciation of 63.8 percent and 41.8 percent, respectively.

QTS’s SDP Lift

QTS management credited the company’s Service Delivery Platform (SDP) with driving strong business momentum and efficiencies last year. Management expects the platform to contribute to shareholder value going forward.

“We are seeing tremendous value stemming from SDP in a number of areas, including supporting a successful (customer) win-rate that is increasing our market share at strong and sustainable pricing levels,” QTS CFO Jeff Berson told DCK in an interview.

The operator is itself using the platform “to manage our internal processes with increased efficiency to support higher margin. We are also utilizing SDP machine learning and predictive capabilities to drive a qualified sales lead engine that is further enhancing our sales productivity.”

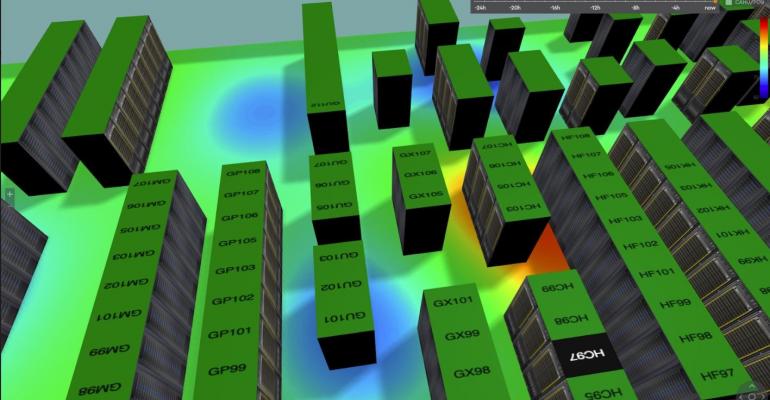

A key customer-facing feature of SDP is the 3D Mapper, which provides a 3D model of the floorspace, analyzing the environment down to sub-one-inch increments. It allows customers to use SDP as an asset-management tool to navigate and view suites and cages and then drill down at the individual cabinet or server level to view utilization, power, and cooling data.

Changes are visualized dynamically, in real-time, and predictive capabilities are currently in development.

2019 SDP business highlights, according to QTS:

- Total contract value of orders placed directly through SDP was up 1,300 percent from 2018

- Unique customers transacting orders on SDP increased 333 percent

- Usage of SDP increased to 17,000-plus active users across more than 1,200 QTS customers

- SDP applications like Power Analytics, which detects when a customer is approaching amperage thresholds and automatically notifies them, generated 63,510 automated notifications of power overages, capturing nearly $250,000 in one-time overage billings. One-quarter of customers receiving overage notifications signed new power-upgrade contracts.

- Approximately 20 percent of new cross-connect orders during 2019 were fully automated via SDP across 14 data centers.

- SDP automation contributed to a 40-percent improvement in implementation from time of order to the provisioning of new services.

- SDP contributed to QTS's industry-leading Net Promoter Score, which last year went from 75 to 87.

Lab-Grown

Earlier this month QTS formalized its digital-transformation efforts by launching a dedicated unit called QTS Innovation Lab.

Brent Bentsen, the company’s CTO of product, described QIL as “a natural extension of our Service Delivery Platform and an innovative development environment leveraging actionable data to rapidly accelerate delivery of innovative new applications and services. Our expanding experience with AI, machine learning and predictive analytics has led to the realization of how much more is possible.”

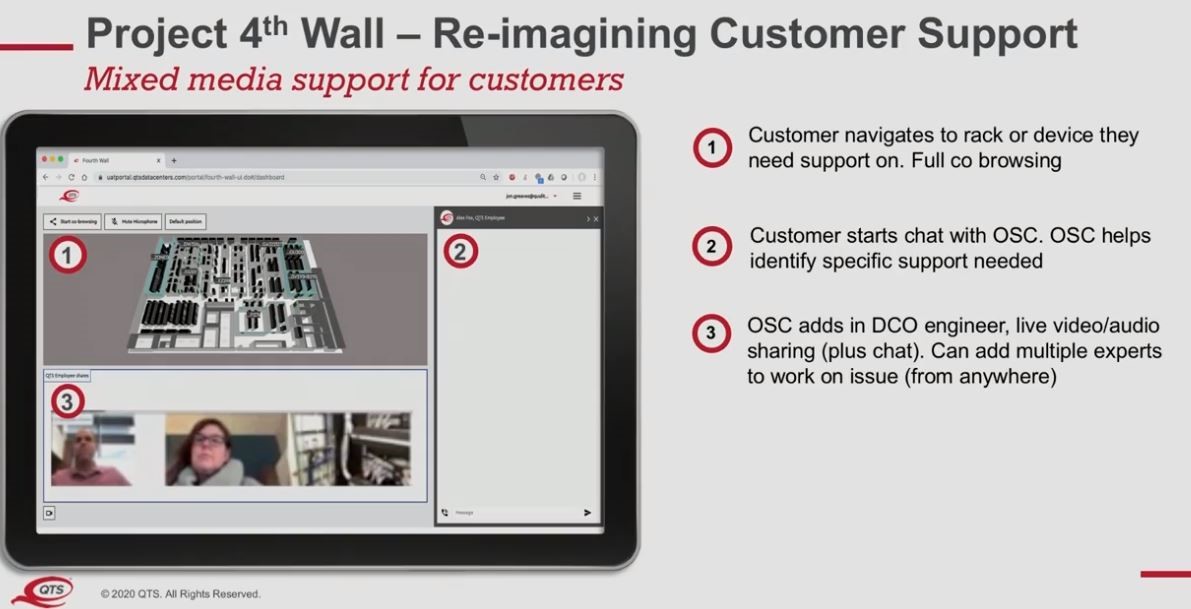

One new tool in the works at QIL is called “Project 4th Wall.” It’s a collaboration tool that will enable up to eight people to remotely share and visualize real-time data, images, and live video from racks and other assets within their data centers on mobile devices.

Customers will be able to easily coordinate with QTS operating staff, for example, while everyone looks at the same spatial information and rack data.

The operator’s sales team will be able to use the tool to give prospective customers a 3D virtual tour of any data center in the fleet.

Investor Edge

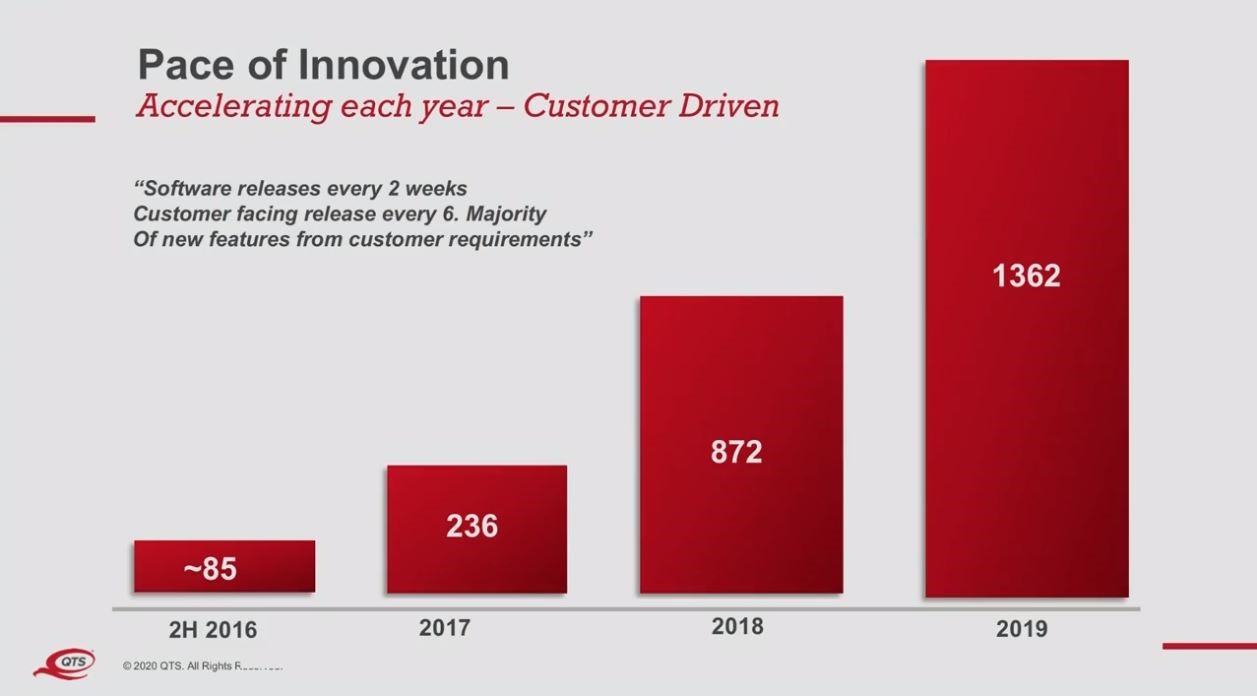

QTS is currently ahead of its peers in digitizing the data center customer experience. It’s been actively developing its software solution during the past four years and says it continues to roll out enhancements to customers on a six-week cycle.

All things being equal, the software tools have “become a tie-breaker when competing for colocation customers in the same market,” Bentsen told us.

It is important for investors to realize the data center industry is quickly evolving beyond just providing enterprise customers four walls, a roof, power, cooling, and access to network infrastructure. Digital transformation has come to the data center-provider industry and will play a growing role in competition.