(Bloomberg) -- The US and its allies should go further than barring Chinese access to advanced chipmaking gear and restrict older semiconductor technologies as well, a prominent think tank said in a new report.

China is building up massive production capacity of so-called foundational chips, which are less sophisticated components used in everything from cars to phones, according to the Washington-based Silverado Policy Accelerator. Now, Silverado warns, the Asian superpower is showing signs of undercutting prices of its Western competitors in this market.

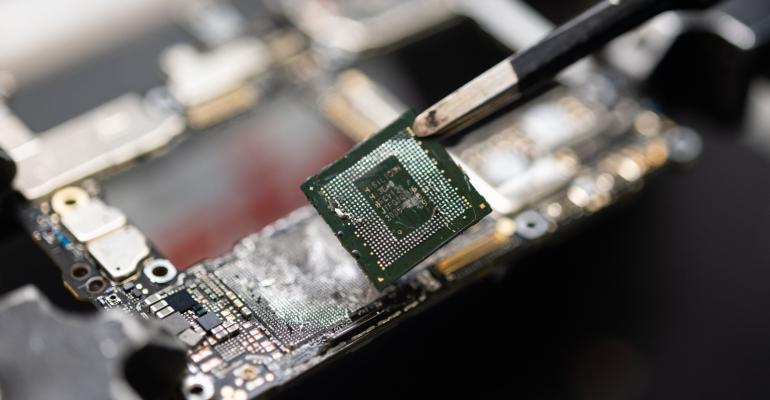

This raises concern that Chinese chipmakers could wipe out foreign rivals, posing a major threat to US national security, said Silverado Chairman Dmitri Alperovitch. While these foundational semiconductors — sometimes called legacy chips — aren’t at the cutting edge, they’re still used widely in the most advanced smartphones, data centers, and military technology.

“The vast majority of chips — almost all chips that go into the weapons systems — are foundational chips,” said Alperovitch, whose group describes itself as a bipartisan organization focused on trade, the economy and cyberspace. “So if you’re concerned about a reliance on foundational chips from China in our most sensitive weapons systems, I think that’s a national security case right there.”

Though the US last year banned the purchase of certain Chinese chips for government or military use, that doesn’t go into effect until 2027.

Once China has built up foundational chip capacity, firms can use that knowledge to produce more advanced models, Alperovitch said. That includes the kinds of technology that the US is trying to keep out of Beijing’s hands. He pointed to Taiwan Semiconductor Manufacturing Co., which started decades ago with older semiconductors and now makes 90% of the world’s most cutting-edge chips.

During the height of the Covid pandemic, it was a shortage of foundational chips that bedeviled automakers and tech giants like Apple Inc., Alperovitch said, highlighting the importance of these semiconductors.

Some Chinese foundational chips are already priced 20% to 30% cheaper than offerings from foreign rivals, according to Silverado’s report. At one point in 2022, Chinese chipmaker GigaDevice Semiconductor Inc. was charging only about one-fourth of what STMicroelectronics NV was asking for comparable products in China, according to a chart in the report attributed to Minsheng Securities.

The US and its European allies are worried that China could eventually dump those cheaper chips on the global market or use them as political leverage. But so far, the Biden administration has focused its policy efforts on just the most advanced chips and equipment — technology it fears will give China a military edge.

To counter undercutting before it’s too late, Silverado said, the US should use investment review and trade investigation tools — as well as gather better pricing and product data — to defend chipmakers in America and allied nations. The report also suggested that the US use export controls to limit shipments of chipmaking technology, not just for advanced chips but for older varieties as well.

While these components are often called legacy chips, that is something of a misnomer. The semiconductors are crafted on machines that use older production technologies, but their designs are often brand new. They are used in far vaster quantities than the most advanced chips because they’ve been incorporated into a wide range of products over years or even decades.

US Commerce Secretary Gina Raimondo has said that the US will use “all the tools at our disposal” to address dumping or other economic issues related to less sophisticated semiconductors. But export controls are not on the table on those products, she said.

“If they have so much government subsidy of legacy chips and flood the market with underpriced chips, that distorts the market. That’s what you’ve seen China do with steel and aluminum,” Raimondo said during an August trip to China, adding that she voiced those worries in meetings with Chinese officials. “I was very clear that that kind of market distortion isn’t a level playing field.”

US Undersecretary of Commerce for Industry and Security Alan Estevez has also indicated indicated tariffs may be a better tool than export controls in dealing with China’s legacy chip issues.

“There are other tools for getting after dumping,” he said.