Chip Bull Run Teeters Near End as Nvidia, Applied Materials Sink

Nvidia and Applied Materials tumbled following disappointing sales forecasts •The tumble added to evidence that a bull run for the chip industry is coming to a close•The chipmaker funk has been hastened by the China-US trade war•There are also signs that the years-long boom in demand for data center servers is slowing

November 16, 2018

Jeran Wittenstein and Ian King (Bloomberg) -- Carnage in chipmaking stocks continued Friday, as Nvidia Corp. and Applied Materials Inc. tumbled following disappointing sales forecasts, adding to evidence that a half-decade long bull run for the $400 billion chip industry is coming to a close.

Applied Materials, the world’s largest maker of equipment used in semiconductor production, projected first-quarter revenue that trailed estimates. Chief Executive Officer Gary Dickerson said on an earnings call that weaker demand in the server, personal computer and mobile markets are making his customers less willing to invest in new production. The stock fell as much as 8.4 percent Friday in New York.

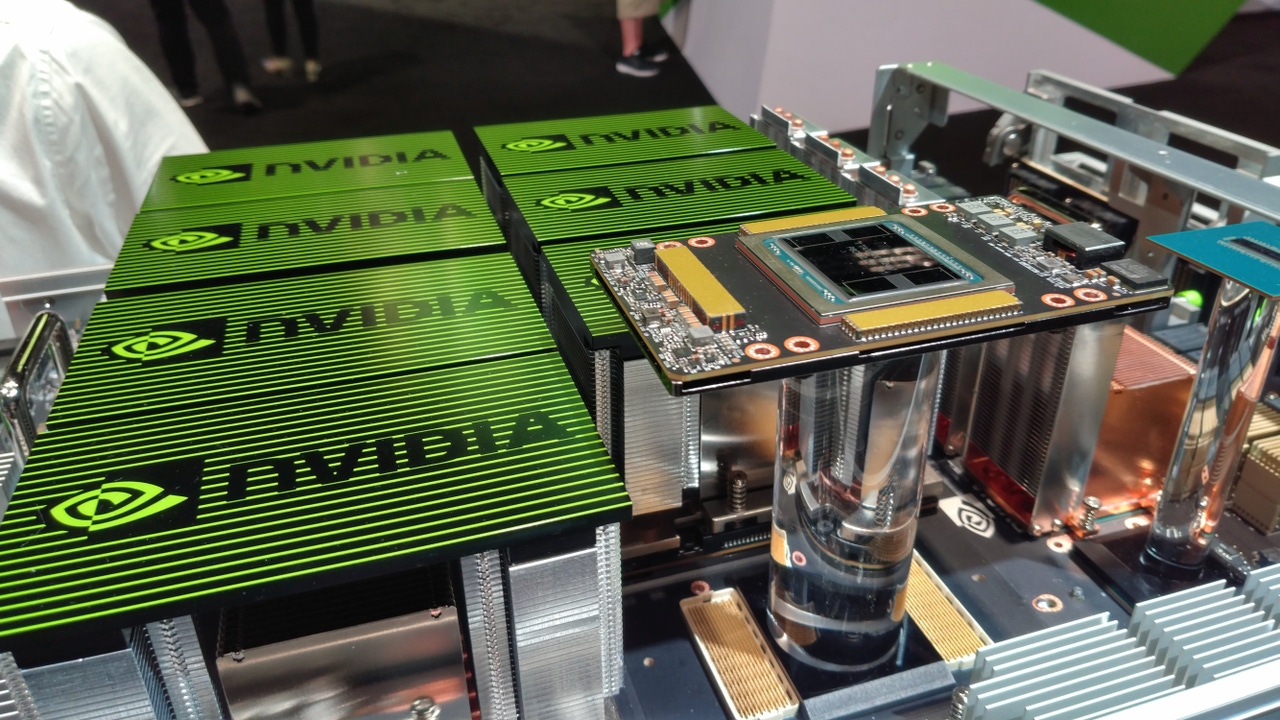

Nvidia, the leader in chips for computer graphics, tumbled 20 percent, the most in 10 years, after projecting sales for the current quarter that also fell short of analysts’ estimates. Disappearing cryptocurrency orders resulted in higher inventory levels, while falling prices failed to spark demand, Chief Executive Officer Jensen Huang said.

Goldman Sachs Group Inc. removed Nvidia from its conviction list, saying it was “clearly wrong on the stock,” and cut its price target to $200. The firm did keep its buy rating, however, writing in a note that it still has “access to one of the best growth opportunity sets in semis,” and a “sustainable competitive lead.”

The chipmaker funk has been hastened by a trade war between the U.S. and China, which threatens demand for a broad range of chip-powered devices. China is the biggest consumer of semiconductors and home to a crucial part of the world’s electronics supply chain. Also weighing on the industry: signs that the years-long boom in demand for data center servers -- and the semiconductors that run them -- is slowing. Alphabet Inc., Amazon.com Inc. and Facebook Inc. have spent lavishly on data centers to handle the growing amounts of data shared online, and analysts fret that the spree won’t last.

Results from Nvidia and Applied Materials contributed to a rout kicked off by Texas Instruments Inc., the chipmaker with the broadest reach in the industry, which warned of a general slowdown in orders across all of its markets. The losses continued when Advanced Micro Devices Inc. reported single-digit quarterly revenue growth for the first time in two years, causing it to drop almost 30 percent in three days.

After surging about 30 percent or more in four out of the last five years, the Philadelphia Stock Exchange Semiconductor Index has lost almost 10 percent of its value since the beginning of October and is now down for the year. The index reached a record in March.

The results released Thursday dragged on the rest of the industry. Advanced Micro Devices tumbled 6.8 percent, while semiconductor equipment manufacturers Lam Research Corp. and KLA-Tencor Corp. also slipped.

At Nvidia, Huang is trying to make the company more than just the top provider of technology that makes games more realistic. Yet the gaming market still provides the company with the bulk of its sales.

The mining of cryptocurrency tokens, computer code that carries value in online transactions, had helped stoke demand for graphics chips. Shortages related to a spike in demand from miners led to an oversupply of parts when the crypto market crashed. That inventory needs to be sold before orders for new parts will pick up again, according to analysts.

Applied Materials’ results, meantime, indicate the chip industry is holding off on expansion plans in the face of the murky outlook for electronics demand.

The company is a bellwether for the industry because chipmakers must buy gear from Applied Materials well ahead of new manufacturing plans. When the industry is cutting back, Applied Materials is often one of the first to feel those chills, too. After hitting a record earlier this year, the company’s shares have dropped more than 40 percent.

The increasing difficulty of manufacturing chips and the addition of electronic functions in everything from cars to fridges fueled a four-year boom. But there are now signs this is another cyclical downturn.

About the Author(s)

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)