High-Speed Trading Networks Getting Even Faster

The fiber networks driving high-speed trading for major stock exchanges are about to get even faster. Sidera Networks says it will conduct a major upgrade of its low-latency fiber routes connecting major financial data centers in New York and New Jersey,

July 23, 2012

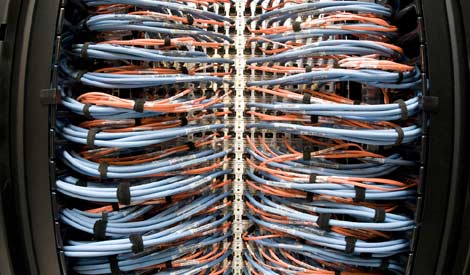

networkcabling

The fiber networks driving high-speed trading for major stock exchanges are about to get even faster. Sidera Networks says it will conduct a major upgrade of its low-latency fiber routes connecting major financial data centers in New York and New Jersey, accelerating one of the networks that ties together key trading hubs for the NYSE, NASDAQ and dozens of global exchanges and trading firms.

The move underscores the competition among infrastructure providers serving the high-speed trading community, in which a fraction of a second can affect the profitability of a trade. That's driving a push for lower latency in trade execution, which includes faster routers that claim the ability to execute trades in nanoseconds.

For fiber providers, that means finding the shortest routes between key data centers, and putting powerful equipment on each end of those cables. Sidera's network optimization includes "pulling slack that was originally built into the routes," according to Joe Cumello, the company's VP Marketing. Sidera is also upgrading equipment and laying new fiber. The net result, the company says, is a distant advantage in which its routes are 1 kilometer to 10 kilometers shorter than competitors, depending upon the route.

“We have committed to customers that we will maintain our low latency edge so that they can meet their application requirements, including electronic trading," said Clint Heiden, President of Sidera Networks. "When completed, this upgrade will deliver on that commitment. Additionally, low latency connectivity to NYSE’s Mahwah, NJ data center is critical to our customers. We will provide a unique, low latency connection to that facility.”

Sidera’s Xtreme Ultra-Low Latency Network is among the networks connecting financial data centers and exchanges in the New York area, including the NYSE facility in Mahwah, the NASDAQ trading venue in Carteret, NJ, 300 Boulevard East in Weehawken (home to a Savvis trading hub), an Equinix colocation center in Secaucus, 165 Halsey Street in Newark and the Google building (111 8th Avenue) in Manhattan.

“Network connectivity is key to any company’s ability to transact and access information,” comments Larry Tabb, Founder & CEO of the Tabb Group. “The New York/New Jersey market is an important region for the financial services market. There are exchanges; market data hubs and other key data housed in these data centers throughout the region. Network redundancy, reliability and accessibility to these information hubs are key concerns for companies as they architect their networks for more efficient communications.”

About the Author(s)

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)