So far, the winners from the Switch IPO have been the original investors and Wall Street insiders allocated IPO shares. However, it appears another group had benefited -- holders of the other data center stocks (the big US data center REITs) who received a nice boost in share price going into earnings season.

The Switch IPO helped to shine a bright spotlight on the entire data center industry. There was much to like about the Switch story: a visionary founder, oodles of intellectual property (mostly patented and patent-pending data center designs), and an impressive customer base of over 800 tenants, including some of the most coveted hyper-scalers.

The story of Switch as a publicly traded company began on October 6th, when an all-star team of Wall Street investment banks engineered a successful IPO. However, most retail investors who purchased Switch shares on the open market hoping to "get in on the action" have so far not fared as well.

The IPO was a tremendous success for the company, and especially the original Switch, Ltd. investors, including the founder and his executive team.

First Week of Trading

The first-week stats for Switch shares were impressive: 1) The IPO priced at $17.00, a dollar above the high end of the expected range; 2) Shares opened trading at $21.70, indicating a large appetite for the second-largest tech IPO of the year, bid up as high as $24.90 by eager retail investors the first morning of trading; and 3) Switch IPO raised $611 million, including the 4.68 million share underwriter allotment, for a total of 35.9 million new Class-A shares.

However, the Switch share price weakened toward the end of the first trading day, closing near the intraday low at $20.84 per share. This meant that investors with access to $17.00 IPO shares ended the day +22.5 percent. Shares closed significantly off the 44 percent intraday trading high of $24.90 per share in the first hour but recorded a strong first day nonetheless.

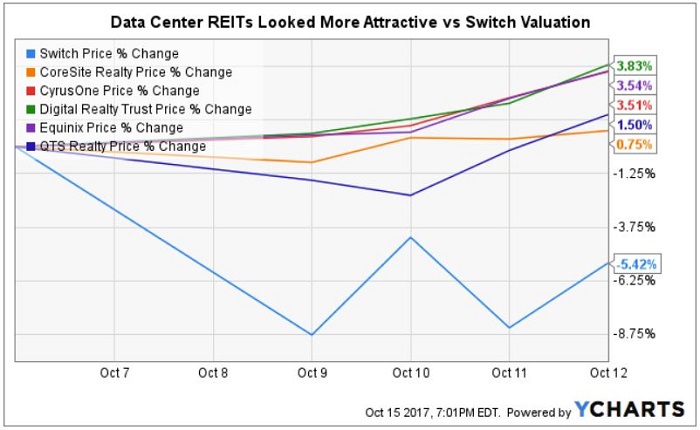

The chart above shows the best case for a retail investor who bought Switch shares during the first day of trading and held them for a week. The loss of -5.4 percent is calculated from the close of trading on October 6th, $20.84 per share, compared with the $19.72 closing price after five trading days were officially in the books.

On day one, Switch shares opened at $21.70, and then were quickly bid up to $24.90 by retail investors looking to "get in early" on the Switch investing opportunity. Notably, first-day performance for those eager shareholders hoping to ride the upward momentum would equate to paper losses of -9.1 percent for those who bought at the open and -16.3 percent for those who bought at the $24.90 peak.

A Spotlight on Valuation

On October 6, Jim Cramer, host of the popular CNBC "infotainment" show Mad Money, did a long segment on the Switch IPO for his audience. Cramer's show is widely followed, compared with most financial cable shows and media outlets. His segment was focusing on answering the question: "Is SWCH Worth Owning After Its Monster Move?"

Cramer likes data center stocks, noting that the sector has been outperforming the general market. The conclusion he reached and shared with his audience was that Switch shares were being valued at ~76x 2018 estimated earnings, making the stock too richly priced to recommend. Even if Switch had priced at $15.00 (the mid-range of the IPO), that would have equated to ~53x next year's earnings. Cramer noted that shares of chip juggernaut NVIDIA, with 41 percent earnings growth, were trading at a P/E under 50x.

Shares of other data center providers -- CoreSite, Equinix, Digital Realty, CyrusOne, and QTS Realty -- have seen big gains this year. However, they still trade in multiples that range from 21x to 25x FFO or AFFO per share. Notably, these multiples are toward the higher end of the data center REIT sector historical trading range.

Nice Week for Data Center REITs

It is important to remember that all five of the incumbent data center REITs have been regularly growing funds available for distribution, or AFFO, each year. REIT cash distributions provide shareholders current income, and growing dividends has helped drive share price appreciation, delivering outstanding total returns.

The five non-Switch US data center stocks were generally viewed as fairly valued going into Q3 2017 earnings. However, compared with the Switch post-IPO valuation, these REITs looked relatively inexpensive. This may have accounted for some of the spike last week.

Switch – Controlled Entity Issues

Switch has an unusually complicated equity structure for a public company, intended to leave control of the company firmly in the hands of founder and CEO Rob Roy. Based on the company’s 8-K filing last week, it was still unclear how much Switch Inc. (the holding company) will be paying to members of the Switch Ltd partnership when the partnership units are converted into Switch common shares under the terms of an unusual Tax Receivable Agreement.

As TheStreet.com recently noted, Switch will be excluded from participating in S&P Dow Jones Indices, including the S&P 500, after the index provider moved in August to exclude businesses that issue multiple classes of shares giving insiders control of the votes from participating in its indexes.

Notably, both Equinix and Digital Realty, the two larger-cap names in the data center sector, are both members of the coveted S&P 500 index. S&P 500 membership helps create demand from institutional investors for the shares as well as mutual funds and ETFs that attempt to mirror the performance of benchmark indices.

Switch isn't a REIT

As a C-Corp, Switch Inc will be able to plow back all its earnings into future growth and eventually bank retained earnings -- an option REITs do not have.

REITs must tap the debt and equity capital markets to help fund growth because REITs are required by law to distribute at least 90 percent of taxable income to shareholders as dividends. The combination of current income, dividend growth, and double-digit total returns has made data center REITs a popular investor choice, and the leading REIT sub-sector for the past two years.

However, while Switch views itself as a technology company, its core data center operations will require substantial amounts of capital to develop and continue to expand. The initial phases of massive data center campuses require a disproportionately large investment relative to the return on invested capital. Later phases are typically far more profitable as they are built out over time and leased up.

Investor Edge

The hype and sizzle of a technology IPO can draw eager investors hoping to buy into the next Apple or Amazon. However, without a dividend, demand for Switch shares will not be coming from many dedicated REIT investors. Notably, Moody's has predicted Switch will be cash flow-negative for the next two years.

As of this writing, Switch will be reporting results for Q3 2017 after the bell on November 30, with president Thomas Morton and CFO Gabe Nacht hosting a conference call. This will be an opportunity for Switch management to set the tone regarding disclosure and alignment of management interests with those of common shareholders.

Hopefully, the company presentation will shed light on issues such as remaining lease terms for key customers and provide a detailed budget for campus expansions with cash flow projections as well as financial details regarding the impacts of the unusual Tax Receivable Agreement.

Mr. Market hates uncertainty, and lacking adequate disclosure and guidance tends to factor in the worst case. Transparency on the part of Switch management will be crucial to gaining investor confidence. Agreeing to host a conference call when there is no requirement to do so certainly appears to be a step in the right direction.