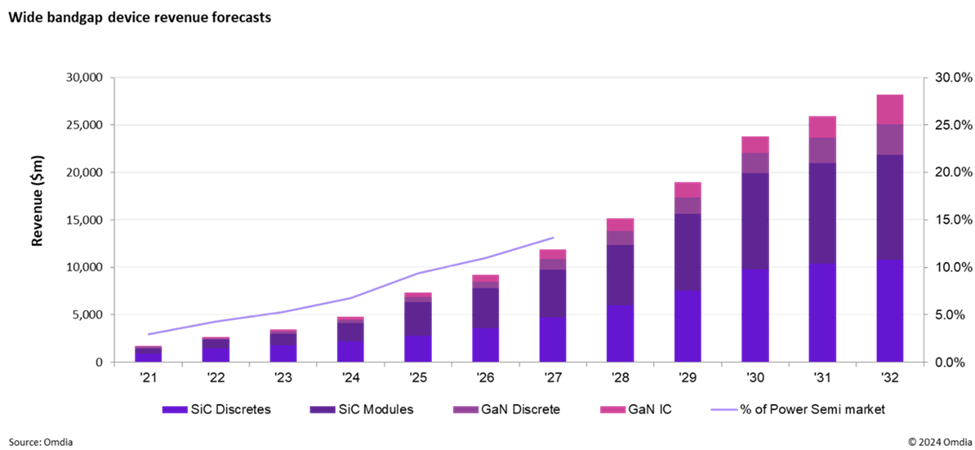

The semiconductors used to power industrial, automotive, computing, and consumer equipment are not as well-known as the silicon chips that enable other applications. However, they account for approximately 10% of overall semiconductor revenue, which makes them a $30 billion market.

Power semiconductors, and wide bandgap semiconductors in particular, are critical to the world’s attempts to meet its sustainability goals. Wide bandgap devices can operate at higher voltages, frequencies, and temperatures than other chips, which improves the efficiency of a device. Two materials, silicon carbide (SiC) and gallium nitride (GaN), are particularly relevant. They’re not new but, so far, demand for them has been limited by concerns about their application, cost, and reliability or by the available capacity.

However, that’s beginning to change. More SiC and GaN semiconductors are being deployed in equipment such as wind turbines, photovoltaic inverters, motor drives, and electric and hybrid vehicles. The market for them is now growing significantly faster than the market for silicon power semiconductors. We expect revenue will continue to increase, from 3% of the power semiconductor market in 2022 to 13.1% in 2027.

The Need for Efficiency Drives Growth

The drive for efficiency will continue as countries strive to achieve greater energy security, and businesses and industries seek to improve their energy efficiency and meet carbon reduction goals. Many sectors will come under further pressure to minimize their impact. That includes data centers, which are already energy-intensive and could become even more so given advances in artificial intelligence (AI).

AI requires significant computing power and the operators of the high-performance data centers that make that level of compute possible will want to ensure their facilities can manage the workload efficiently, so their energy costs and footprint don’t become excessive. Power supplies are crucial to achieving this and wide bandgap semiconductors, and GaN specifically, could help operators save in three areas: energy loss, the costs of cooling the data centers, and the space required for servers.

Data centers use a lot of energy, but they don’t operate at high voltages, which means GaN semiconductors, which are commonly used in devices such as laptop, tablet, and phone chargers, may offer greater benefits than SiC semiconductors, which are optimized for industries such as power transmission and automotive.

GaN devices reduce the energy lost in data centers by operating more efficiently within the main server power supply. The excellent on-resistance and high switching speeds achievable in GaN-based solutions result in much lower energy losses. This reduces the energy demand of the server rack and can also reduce the demand on the cooling systems within the data center.

Together, a reduction in energy loss and cooling requirements means that energy consumption could be reduced. The power semiconductor company, Infineon, is investing in GaN technology and completed its acquisition of GaN Systems late last year. It believes the amount of energy used in a data center could be cut by 10% if operators switch from silicon to GaN-based power supply units. It goes on to say that 20TWh of energy could be saved annually if all data centers switched.

Space Savings

Finally, the use of GaN enables manufacturers to reduce the size of the power supplies. In a data center, the more efficient use of space creates extra room for CPUs and GPUs, which are the components that generate income for operators. That means they can earn more from their existing data center or build efficiency into their new facilities.

Developing a Certified Solution

Despite the potential benefits, Omdia isn’t expecting operators to upgrade their power supplies immediately. Instead, we expect a more gradual shift. Operators may wait until their existing devices reach their natural end of life and consider more efficient technologies at that point. Manufacturers may also need to convince operators that GaN semiconductors, which are currently used in low cost and low margin applications, are robust and reliant enough for the critical data center environment. In a data center, downtime can have a significant financial and reputational impact so operators will be unlikely to take risks.

However, lessons can be learned from the hybrid and electric vehicle market. There, SiC semiconductors are increasingly being used to extend a vehicle’s range and performance, with adoption being led by Tesla. Initial concerns about the technology have been addressed and the devices are now considered high quality and high value, and manufacturers invest in continuously improving the technology and introducing new features. There’s an opportunity for GaN semiconductors to evolve in the same way within the data center market.

Established Facilities and Supply Chain

Semiconductor manufacturers are well positioned for growth. GaN devices are produced in a similar way to silicon chips, so existing facilities can be repurposed and there’s an established supply chain. However, they will need to find a way to maintain their margins and capacity since more data centers continue to be built. If they meet this challenge, there is an opportunity to maximize their efficiency with these new technologies.

The need to limit our impact on the planet has never been greater and wide bandgap devices offer a step change in the level of efficiency that can be achieved. And who knows, in time, there may be an opportunity to use the AI they power to generate even greater benefits.