Critical Thinking is a weekly column on innovation in data center infrastructure design and management. More about the column and the author here.

The chief executive of direct liquid cooling specialist Asetek revealed this week that the Danish company is about to announce a high-profile partner that could give its data center business a significant lift. “The data center is where the biggest potential is long-term,” CEO Andre Eriksen told Bloomberg. “In the longer perspective, I believe that data centers will be liquid cooled.”

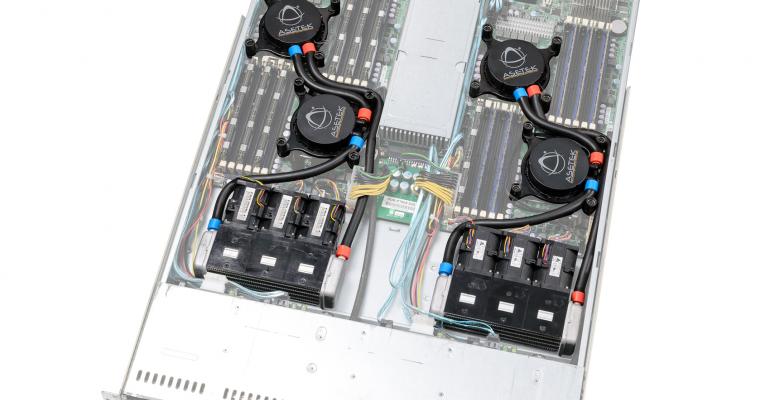

The identity of the partner remains a mystery but some experts have postulated that it could be chipmaker Intel. That would be quite a coup for Asetek, which despite impressive stock performance and revenue growth of more 20 percent compared with the first half of 2016 made a pre-tax loss of $0.6 million in Q2 2017. Overall, Asetek’s data center business generated revenues of $1.4 million in the first half of 2017 compared to $21 million for its desktop direct liquid cooling products. However, it has had a number of notable data center customer wins recently, including licensing its technology to Fujitsu and Penguin Computing.

Asetek Not the Only Game in Town

Asetek’s closest rival is probably privately-held CoolIT Systems, based in Canada. The companies are arguably the two biggest dedicated suppliers of direct liquid cooling, or DLC, technology across high-end PCs (mostly used for gaming) as well as the data center. Both players specialize in a form of DLC based on the use of water-cooled cold plates. There are some differences in how the two companies distribute warm water, but the technologies are broadly similar – perhaps too similar. In June 2015, the US District Court for the Northern California (San Jose) ruled that CoolIT Systems pay damages to Asetek of $1.9 million for patent infringement.

CoolIT also has secured a number of high-profile partnerships over the recent past. This past June, it announced a partnership with Dell EMC to integrate its technology into Dell’s PowerEdge Servers. The deal was notable as Dell has historically been one of the more reluctant server OEMs when it comes to direct liquid cooling (although it did develop a DLC system for eBay in 2016). In 2016, CoolIT also announced a partnership with Hewlett Packard Enterprise for the server-maker’s Apollo 2000 system. HPE also developed its own DLC system – the Apollo 8000 – for high-performance computing in 2014. The deals demonstrate that despite investing in their own DLC, the two OEMs were persuaded by CoolIT’s technology.

CoolIT has also benefited from a partnership with, and investment from, the German company Stulz -- one of the global leaders in data center cooling systems. The partners most recently collaborated on a range of micro-modular data centers known as the STULZ Micro DC. Designed specifically for high-performance computing (HPC), the self-contained unit of whitespace can support rack power densities up to 80kW.

But CoolIT isn’t Asetek’s only competitor. Other cold-plate systems include California-based Chilldyne, which uses negative pressure to reduce leakage. It is a smaller player than CoolIT or Asetek but has had some recent successes and is currently working on a project for DARPA.

While warm-water, cold-plate technology is flexible and relatively easy to retrofit into existing data centers, it is arguably less efficient than immersion direct liquid cooling technology. Proponents of immersion liquid cooling include UK-based Iceotope (backed by Schneider Electric), Green Revolution Cooling (GRC), LiquidCool Systems, and Netherlands-based Asperitas, a recent entrant. Immersion has some benefits over cold plates, as a much higher percentage of the server heat load is captured in the liquid. This means facilities that used only immersion-cooled servers – a rarity outside HPC right now – could eliminate costly mechanical air-based cooling entirely and simply use dry coolers or other relatively low-cost heat ejection technology.

AI Becomes the Push DLC Needed

Up until very recently, the infighting between different DLC suppliers appeared like wasted effort. The real battle for most DLC suppliers should have been in overcoming the air-cooling orthodoxy that has pervaded most of the industry to date. However, attitudes may be shifting; expected growth in deep learning and other forms of AI-related compute-intensive applications could see greater demand for direct liquid cooling outside of traditional HPC.

Chilldyne says although its technology supports a range of processors, the majority of its sales are for GPU-based systems. For example, it recently shipped a 350kW system to South Korea to cool 132 servers equipped with 1056 AMD R9 290X GPUs. “DLC makes it easier to have one set of racks at 5kW and another set at 60kW. It’s very hard to have your air conditioning go up and down to support that. Rear-door heat exchangers might help with some of that but there’s a limit to that too,” Steve Harrington, CTO at Chilldyne told Data Center Knowledge. He said the cooling capacity of DLC also means that some customers can use consumer-grade GPUs for HPC applications. “Normally that would be a problem, because they would overheat, but the liquid cooling prevents that,” he added.

Demand for direct liquid cooling also appears to be growing in colocation. Neil Cresswell, chief executive of the UK-based data center operator Virtus, which recently announced a 90MW campus outside London, told Data Center Knowledge that he thinks DLC will be integrated into more colocation facilities in the near future.

Tate Cantrell, CTO of the Iceland-based colocation provider Verne Global, said he expects to see more customers looking to deploy DLC-based systems in the future. “We don’t force the industry to adopt liquid cooling, but if liquid cooling is what is required -- a number of our customers that have traditional Cray-style compute use liquid cooling -- then it’s very easy to accommodate in Iceland,” he said.

China-based cloud operators Baidu and Alibaba are also investing in DLC technology to support their use of AI.

Separately, there is also expected to be increased demand for systems such as the CoolIT Stulz micro-data center designs, as the Internet of Things creates more demand for edge compute with self-contained cooling outside of traditional white space.

Asetek is due to announce its mystery partner at the SC17 HPC event in Denver in November, which will also likely to showcase other developments in direct liquid cooling. If the event is anything like its European counterpart ISC 2017, then AI and deep learning are likely to dominate the conversation. DLC suppliers, and any new partners that might emerge, will want to make sure they feature in those discussions.