The world’s top cloud providers made $11.2 billion in revenue selling raw compute and storage power as virtual services last year, but, according to a recently published market analyst report, it’s only the beginning.

The report by Structure Research focuses on a select group of the largest "massive-scale" Infrastructure-as-a-Service clouds. It forecasts that collectively this group will reach more than $120 billion in revenue in 2020, growing the market more than 10-fold in just five years.

Gartner estimates that the entire IaaS market’s size was $16.2 billion in 2015 and forecasts that it will reach $22.4 billion this year – a 38.4-percent year-over-year growth rate. By Structure’s estimate, the seven top cloud providers it chose for its report will have made $18.8 billion – a much higher, 67.9-percent growth rate.

If the two research firms’ estimates are close to the truth, the difference in their projected growth rates means bigger and bigger piece of the IaaS cloud pie will be eaten by the biggest players in the space.

Data Center Land Grab Will Continue

Bullish cloud market growth forecasts are good news for the largest wholesale data center service providers, who have been unable to build data center space in key markets quickly enough to keep up with demand for capacity from the top cloud providers.

Wholesale data center providers and commercial real estate brokers have said recently that they have never seen a land grab by cloud companies of such scale and pace. Since these developers are now navigating in uncharted waters, the natural question is how long this land grab will continue.

Read more: How Long Will the Cloud Data Center Land Grab Last?

While year-over-year growth will decline percentage wise, the market for IaaS will continue growing into the foreseeable future, which means data center providers can count on at least several more years of high demand from this customer segment, according to Structure.

“All signs point in one direction,” Philbert Shih, managing director at Structure Research and one of the report’s authors, said. “Most people agree that that’s the case.”

If the massive-scale cloud market continues along its current trajectory, the wholesale data center providers can be fully expected to maintain their current momentum inside and outside of the US, he said.

This trend’s impact will continue increasing outside of the US, Shih pointed out. The further from the US they expand, the less likely the US-based cloud giants are to build their own data centers, he explained.

Who is Big Enough?

The report takes a narrow scope, focusing on pure Infrastructure-as-a-Service and looking at seven companies Structure considers to be raking in the most revenue from IaaS.

While most of the providers the analysts looked at break out cloud revenue in their earnings reports, not one of them says how much it makes from IaaS specifically, so estimating how much they make just from renting out raw cloud compute and storage capacity is always an exercise in extrapolation.

Structure’s threshold for including a company in the report was $250 million in annual revenue from IaaS.

The research firm did however include two EMC subsidiaries (VMware and Virtustream), which by its estimates made a combined $171 million in revenue last year. VMware and EMC’s leadership have considered merging Virtustream with VMware’s vCloud Air business, but VMware backed out of the deal following the announcement of a planned merger between EMC and Dell.

Shih explained that the huge existing install base of VMware’s software products in enterprise data centers is an advantage for its cloud business that’s “hard to ignore.” vCloud Air and Virtustream are included in the report together because they have a common owner and because there’s still a possibility that the two will merge, he said.

Structure expects both to grow and together to easily cross the $250-million threshold sometime soon, Shih said.

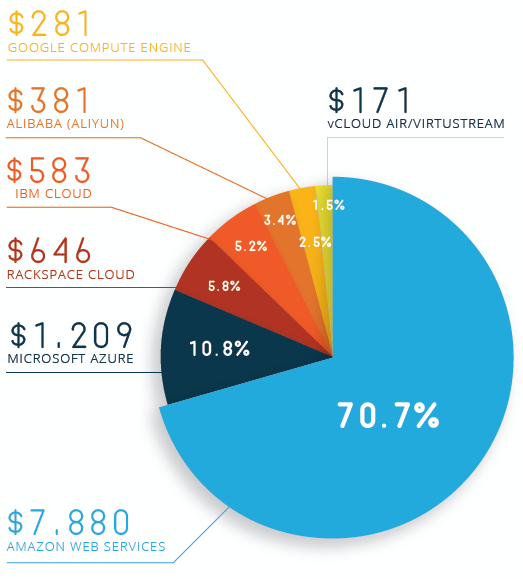

The largest cloud provider is of course Amazon Web Services, which by Structure’s estimate made $7.88 billion in revenue from IaaS last year. The company currently holds just over 70 percent of the market.

Microsoft is a distant second with close to 11 percent of the market and $1.2 billion in IaaS revenue.

Rackspace, IBM Cloud, Chinese internet giant Alibaba’s cloud arm Aliyun, and Google Compute Engine follow (in that order):

Source: Massive-Scale Cloud, April 30, 2016, Structure Research

The Android of Cloud?

The numbers put Google’s current push to expand its cloud business in perspective, showing that despite the might of its purse, technical talent, and global data center infrastructure, its cloud business still has a long way to go before it can really claim to be in the same league as AWS, or Azure.

To that end, last year Google hired VMware founder Diane Greene to lead its cloud services business, who has been repeating in press conferences that the company is “dead serious” about cloud. It has also substantially ramped up its data center spend, announcing earlier this year that it will add 10 physical cloud data center locations before the end of 2017.

Read more: What Cloud and AI Do and Don't Mean for Google's Data Center Strategy

The company’s hope is that its cloud business will repeat the trajectory of its Android operating system in the smartphone market, going from a distant latecomer to market leader.

“It’s just so early-stage in the grand scheme of things,” Urs Hölzle, Google’s VP of technical infrastructure, said at a conference last November. While Amazon and Microsoft are leading today, owners of most IT workloads have not yet picked a cloud for those workloads.

“The next five years in cloud are going to [bring] much more evolution than in the last five years. And I think we’re going to be the Android in that story.”

Changes to Come

Given the analyst projections of the cloud market’s growth over the next five years, that scenario isn’t too far-fetched. The balance of power in the cloud market may very well change as it grows that additional $100-something billion.

At least among the top cloud providers, it’s too early to call winners and losers, especially when it gets to the still largely untapped enterprise cloud market, where companies like VMware, Microsoft, and IBM have the clear advantage of having dominated the previous generation of IT infrastructure.

Whether they will succeed in leveraging that advantage to increase their share of the quickly growing pie successfully remains to be seen.