Ted Ritter is a Principal Research Analyst with Nemertes Research.

Given all the time, investment and energy (literally) that enterprise organizations have been making in their data center facilities, you’d think that the availability of such facilities is a non-issue. You’d be wrong.

Nemertes Research predicts a shortage of colocation space in the U.S. beginning this year, growing to a $1.9 billion facilities gap by 2015.

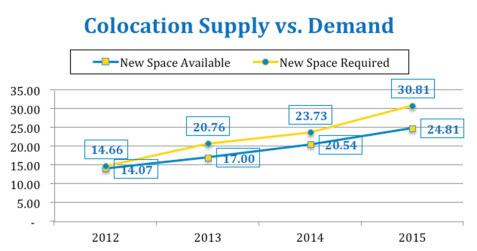

How did we arrive at these conclusions? We looked at the data center market by independently assessing both supply (the current and predicted availability of commercial data center colocation facilities) and demand (the user need for such facilities). And we found that while supply is growing, demand is growing faster. This supply-demand imbalance creates what we’re calling “the colo crunch”.

Supply is Growing…

To assess supply, Nemertes relied on traditional primary and secondary market research techniques to determine the current market size and extrapolate growth rates. We arrived at an overall 2012 domestic market of roughly $18.5 billion in commercial data-center colocation facilities, growing to $31.2 billion in 2015.

How did we get here? First off, the colocation market is fragmented with 16 providers accounting for an estimated 60% of the total market. The remaining 40% of the market consists of hundreds to thousands of small providers. Many of these are mom-and-pop services companies offering one or two racks of colocation for their small customers. We then created an estimate of square feet for each of the 16 large providers.

Some providers disclose colocation revenue but not colocation square feet. Other providers disclose colocation square feet but not revenue. However, enough providers disclose both data points to create a base rate per square foot revenue for colocation. From this we are able to extract square feet from providers only disclosing revenue and revenue from providers only disclosing square feet. In some cases providers offer no insight into either data point and in these cases we estimate square feet and revenue based on provider size and the calculated colocation space of direct competitors. Our findings? Estimated total colocation space in use in the United States in 2011 was 67.7 million square feet. This is projected to expand to 144 million square feet by 2015, based on growth projections by providers.

… But Demand is Growing Faster!

But, as noted, supply is just half the equation. To measure demand, Nemertes conducted primary research to directly collect statistics around data center usage and deployment based on benchmark interviews with several hundred enterprise organizations. However, estimating demand for data center colocation facilities requires a bit more than just measuring data center facilities requirements. We needed to answer the question, “What percentage of data center facilities requirements do enterprises meet today, and want to meet in the future, specifically by colocation?”

The key lies in recognizing two things: First, that enterprises outsource data center facilities for a variety of reasons; and second, that colocation is simply one option in a portfolio of options for data center outsourcing—a portfolio that also includes platform-as-a-service, infrastructure-as-a-service, and cloud services as well as colo. So we had to craft a model that both models outsourcing demand in general, and specifically isolates demand for colo (rather than cloud, IaaS, or other forms of data center outsourcing). The details of the model are too complex to present comprehensively here, but the upshot is the following: Roughly 8.75% of total enterprise data center space is currently in colocation. That total will increase to 14.11% by 2015.

In other words, commercial supply is growing, but enterprise demand is growing faster. Thus, there’s a growing gap between supply and demand (see figure).

The bottom line? Enterprise colocation demand will outstrip colocation service provider supply starting this year, unless colocation providers expand at a faster rate than current growth rates would indicate. In other words: Watch out for the coming colo crunch!

Ted Ritter is a contributing editor for Data Center Knowledge. He is a Principal Research Analyst with Nemertes Research.