Welcome to the week’s roundup of all the biggest news in the data center industry, curated, distilled, and put in context by Data Center Knowledge.

Intel Hell-Bent on Keeping Moore’s Law Alive

As the industry kept writing obituaries for Moore’s Law, Intel said the pattern of processor performance progress described by one of its founders isn’t dead – not if Intel has anything to say about it.

“Until the periodic table is exhausted, we will be relentless in our pursuit of Moore’s Law and our path to innovate with the magic of silicon,” Intel CEO Pat Gelsinger said in a statement that was part of the company’s broad-range roadmap announcement this week:

- Intel’s lag in advancing its process technology has been widely looked at as one of the main signs that it’s losing its leadership position. So, the company decided it will no longer use the traditional nanometer naming convention to describe its chips, claiming that its new convention better reflects the products’ capabilities. So, 10nm Intel chips will be called Intel 7 (its move from 10nm to 7nm process technology is still in progress, while rival TSMC is already moving from 5nm to 3nm), its 7nm chips will be called Intel 4, and so on.

- Following Intel 3 on the roadmap is Intel 20A, which would usher in the “Angstrom era,” where chip innards are measured in angstroms (units even smaller than nanometers).

- Intel 20A, expected to ramp in 2024, will be the company’s first RibbonFET-based processors. RibbonFET is the first new Intel architecture announced in more than a decade since the announcement of the current FinFET architecture.

- 20A will also be the first chip to use Intel’s new PowerVia backside power delivery technology, which “optimizes signal transmission by eliminating the need for power routing on the front side of the wafer.”

CyrusOne ‘Separates’ with CEO Bruce Duncan

Bruce Duncan, who was appointed to lead CyrusOne as CEO only about a year ago, is “separating” with the company. The data center provider announced the change simultaneously with announcing its second-quarter earnings results.

David Ferdman, one of CyrusOne’s founders who had been its CEO until 2010, is taking over for Duncan in the interim, while the board searches for a permanent replacement.

- Duncan’s appointment last year to replace Gary Wojtaszek, who steered the ship for about nine years, surprised many. While a seasoned and successful REIT executive, Duncan didn’t have any experience in the data center business.

- Wojtaszek stepped down after a period of slow hyperscale leasing weighed down on CyrusOne’s stock price.

- Duncan didn’t manage to get the stock back to consistent growth during his short tenure.

Four Data Center REITs Report Q2 Earnings

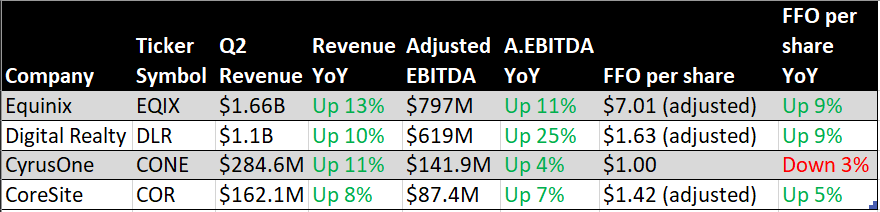

Equinix, Digital Realty, CyrusOne, and CoreSite (four of the six US data center REITs) reported second-quarter earnings this week. All four grew revenue about 10 percent (give or take) from the same period last year.

- All except CyrusOne grew FFO per share (a REIT-specific metric similar to earnings per share).

- QTS, soon to go private, and Iron Mountain report next week.

Here’s a roundup of the key metrics the four companies reported this week:

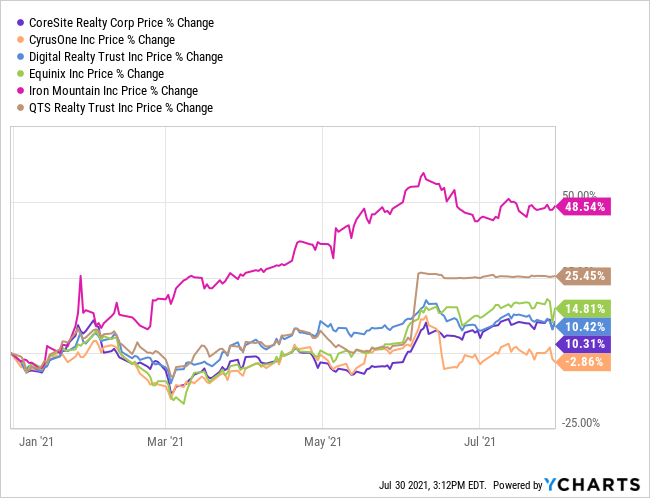

And here’s how all six of the US data center REITs have performed in the stock market so far this year. (All except Iron Mountain are pure data center companies. Iron Mountain is a document storage and management services company with a rapidly growing data center business.)

Another Quarter of Massive Growth for Cloud Giants

The three largest US cloud providers reported their second-quarter earnings this week, and (to no-one’s surprise) they continue growing about as fast as the New Shepard can deliver Jeff Bezos to the edge of the atmosphere.

- AWS revenue was $14.8 billion – up 37 percent year over year, which, according to Bloomberg, was the biggest annual jump in two years.

- Azure reported a 45-percent increase in sales for the quarter from the year before in constant currency. Microsoft doesn’t break out Azure revenue, but sales for Intelligent Cloud, the category including Azure and server software, totaled $17.4 billion, the company said.

- Google Cloud’s revenue for the quarter was up 54 percent year over year, reaching $4.63 billion. The cloud business has also managed to shrink its operating loss from $1.42 billion to $591 million, although part of that shrinkage came from the decision to depreciate its servers over four years instead of three.

Cyxtera Goes Public

Cyxtera Technologies started trading on Nasdaq Friday, the day after the data center provider closed the SPAC merger deal it announced in February.

CYXT stock traded at $9.46 when the market opened and $9.49 when it closed.

It was the first SPAC merger by a data center provider, which took advantage of the relatively quick path to the public markets to access capital to invest in growing the business.

- Cyxtera said Thursday it received about $493 million from the deal with Starboard Value Acquisition Corp. When it first announced the deal, the company said it expected to receive about $654 million. It plans to use the cash to pay down debt, invest in growth, and pay transaction fees.

- Coral Gables, Florida-based Cyxtera, built atop a portfolio of data center assets two private equity firms acquired from CenturyLink (now Lumen), operates 61 data centers in 29 markets around the world.

- It made $690 million in revenue and $213 million in adjusted EBITDA in 2020.

Ampere Buys AI Performance Software Startup

Ampere, the startup that sells Arm chips designed specifically for cloud servers, has struck a deal to acquire OnSpecta, a startup whose software optimizes and accelerates AI inference workloads.

OnSpecta’s Deep Learning Software (DLS) enhances performance of popular inference applications. Its “optimized model zoo” includes models for object detection, video processing, and recommendation engines.

Founded by former Intel president Renee James, Ampere is the hottest Arm server startup around. It’s already struck deals with major cloud providers, including Oracle Cloud, Microsoft, and Tencent.

Instead of targeting a broad customer base (as did the previous generation of Arm servers startups – all gone now), Ampere has been laser focused on designing chips for the needs of cloud providers.

- Ampere and OnSpecta have been working together for some time now. OnSpecta’s software in combination with Ampere servers has been available on Oracle Cloud Infrastructure since May.

- Terms of the deal were not disclosed.

Other Great Reads on DCK This Week

Digital Realty, Zayo Promise Carrier-Grade Enterprise Backbone in a Few Clicks - The backbone capability is the first of several the companies will collaborate on to simplify data center and network procurement for enterprises.

Why CISA’s China Cyberattack Playbook Is Worthy of Your Attention - The advisory outlines the tactics, techniques, and procedures China’s state-sponsored cybercriminals use to breach networks.

DataBank Takes Hands-On Approach to Colocation Clients’ Hybrid Clouds - Its strategy for the hybrid cloud opportunity emphasizes managed services and custom cloud platforms.