Investors in Switch (SWCH) had high hopes last year. The Las Vegas-based data center provider’s NYSE IPO last October was priced above the expected range, and shares were bid up as high as $24.90 on the first day of trading by eager retail investors. Since then, however, they steadily declined as the company’s technology and data center "growth story" slowed considerably.

In its third-quarter earnings report Tuesday Switch missed analyst earnings-per-share estimates by a few pennies, but top-line revenue growth was in line with the previous reduced guidance. Revenue growth slowed to 5.2 percent during the quarter, compared to its pre-IPO compound annual growth rate of 22.3 percent from 2014 to 2017.

Adjusted EBITDA growth fell to 2.3 percent in the latest quarter, compared with a pre-IPO growth rate of 20.2 percent. Additionally, EBITDA margins decreased, in large part due to a 57 percent increase in expenses compared with the same period last year, including a $6 million increase in equity-based compensation.

But the sharp 24-percent drop in Switch common share price two days ago probably had more to do with uncertainty about its future performance. (Switch shares have recovered most of the value they lost Wednesday as of Friday afternoon.)

On the third-quarter earnings call management revealed that a 15MW deal first announced in May will be further delayed. On last quarter's call, the complexity of hybrid colocation and a new customer IT architecture were to blame. This quarter, the same customer was unable to raise the capital required to fund the deployment due to unfavorable conditions in the equity markets. Switch management expressed confidence that this deal will be signed and go forward some time in 2019. Notably, the deployment was expected to ramp over an 18-month to 24-month time frame, further delaying recognition of the revenues.

That wasn’t the only delay. Planned completion of the first 10MW phase of the Atlanta "Keep" campus has been bumped to Q4 2019. This means Atlanta will not be contributing to Switch's revenue growth until 2020. The Atlanta campus is a greenfield ground-up development. One reason management gave for the delay was the unusually large amount of rainfall in the Atlanta area.

Selloff Overdone?

Many analysts still believe Switch's long-term strategy. On Wednesday, Credit Suisse analyst Sami Badri reiterated an Outperform rating on Switch with a $14 price target. Citigroup analyst Michael Rollins also maintained a Buy rating.

After the 24-percent share price drop Wednesday, Raymond James analyst Frank Louthan published a second Switch note the following morning: a double upgrade to Strong Buy 1 from Market Perform 3, based primarily on post-selloff valuation.

Louthan now had an $11 price target, representing an implied 51 percent upside from the prior close of $7.07 per share. It appears that the Raymond James upgrade had a positive impact on Switch shares Thursday, as they were bid up 11 percent on three times the normal trading volume.

Investor Edge

Switch shares have been hammered after reporting results every quarter since the IPO apparently due to management's inability to deliver solid results and communicate realistic expectations analysts can model.

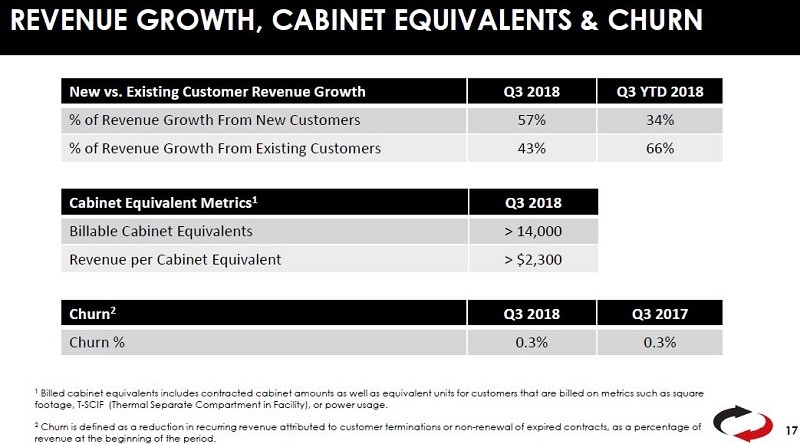

But there have been some positive developments in the third quarter. One improvement was reporting two key metrics for the first time -- the number of cabinet equivalents and average revenue per cabinet equivalent:

Reporting these metrics is an important step toward greater transparency by the Switch management team.

During Q3, Switch hired former Stifel telecom and technology analyst Matt Heinz as VP of investor relations and financial planning and analysis. Heinz is a Wall Street veteran with many years of both buy-side and sell-side experience. His addition to the Switch C-Suite should help communicate a clearer message going forward.

After the market closed Wednesday, Switch filed its 10-Q for the last quarter. The filing showed a liability of $43.4 million under the terms of the Tax Receivable Agreement. The TRA benefits Class-B and Class-C shareholders (initial investors and founder and CEO Rob Roy) and it was highlighted in the Switch IPO prospectus. There was no TRA liability in 2017, so $43.4 million is a large number year-over-year.

The current 10-Q also stated that the TRA liability will be substantial going forward. Another liability hard to quantify are the class-action lawsuits discussed in the 10-Q alleging "breach of fiduciary duty, unjust enrichment, waste of corporate assets, abuse of control, and gross mismanagement." Switch incurred more than $1 million in legal expenses to defend against these lawsuits in the third quarter. Management mentioned neither of these topics on the earnings call.

Long-term investors willing to wait for the Switch growth profile to return to pre-IPO performance have an opportunity to purchase shares near all-time lows. However, this should be patient money. Until Switch can return to a double-digit growth mode, there doesn't seem to be another obvious catalyst for significant price appreciation, at least in the near term.