While growing at a rate that’s similar to other top data center markets, the Hong Kong colocation market may see its growth slow if the small nation's government doesn’t allocate more land for data center construction.

That’s according to the latest market report by Structure Research, which has made a slight downward adjustment to its five-year growth projections for Hong Kong to reflect the very real effect land scarcity is having on the market.

“There has been a lack of new inventory, and without it, there will be fewer options in the market and less opportunity for growth,” Jabez Tan, research director at Structure and author of the report, said. “Despite these challenges, the market remains healthy and continues to move forward. While supply has largely been unchanged, there remains a pipeline of demand and the inventory to support it.”

Hong Kong is one of the most important network hubs mainland Chinese companies use to expand to international markets by establishing data centers there; it is also a gateway to the mainland China market for international players.

The Land Shortage

Scarcity of available land is the biggest problem facing the Hong Kong market today. Land supply is generally low, and the amount of land that can be used for data center development is even lower. The country’s government decides what gets built where, and very little new land has been earmarked for data center construction lately.

Only two new data center builds are currently in the pipeline – one by Global Switch and another by SUNeVision – and only two plots of land are expected to become available for data center construction between now and 2020, Tan said. That, however, may change now that Hong Kong has had its election. (New land allocation had been on hold in the run-up to the election.)

“It could change immediately because Hong Kong just had their election,” he said. “There could be new regulations that are put into place that will open up land for more data centers.”

Wholesale Catching Up to Retail Colo

In line with a global market trend, the mix between wholesale and retail colocation is shifting toward wholesale in Hong Kong, driven largely by demand for large-capacity wholesale data center leases by cloud giants. Unlike North America, where US-based cloud companies are driving that demand, however, it is Chinese providers that are gobbling up much of Hong Kong's capacity, using it as a springboard for international expansion.

These are the usual suspects, such as Tencent and Alibaba, both of whom have been doubling down on their already expansive Hong Kong data center footprint, Tan said. Of the top US-based cloud providers, Microsoft has a sizable Hong Kong deployment with NTT. Its rivals Amazon and Google have cloud data centers in Singapore, the other big network gateway to Asia-Pacific markets.

The split in Hong Kong today is 42 percent wholesale and 58 percent retail, according to Structure. The analysts expect it to even out by 2021.

Growth in Line With Global Trends

Hong Kong was a $706 million data center services market in 2016, up from $616 million in 2015, according to estimates by Structure, which projects it will grow 17 percent this year. The firm expects Hong Kong to grow at a compound annual growth rate of 16 percent between now and 2021. The projected growth rates are slightly above what Tan expects the global colocation market’s growth rate will be this year: 15.2 percent.

For comparison, the North American colocation market generated nearly $14 billion in revenue last year, according to Structure. That’s about 42 percent of the global market.

Here’s the global breakdown for 2016, courtesy of Structure:

Three Providers Run the Game

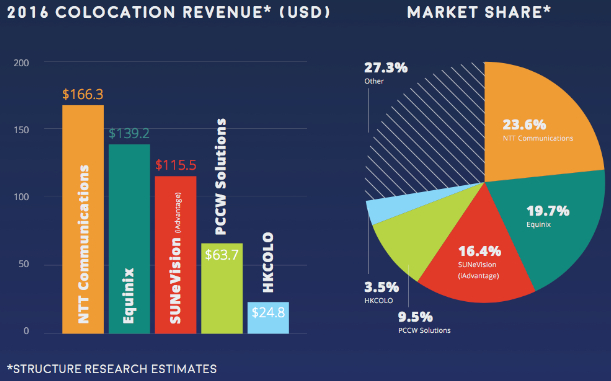

Japan’s NTT Communications has the biggest colocation market share in Hong Kong (24 percent), followed by Silicon Valley-based Equinix (20 percent), and Hong Kong’s own SUNeVision (16 percent). SUNeVision is the tech arm of one of the country’s top real-estate developers, Sun Hung Kai Properties.

Here’s the detailed 2016 Hong Kong colocation data center market share breakdown by Structure (click chart to enlarge):

Correction: A previous version of this article incorrectly said that SUNeVision was based in Singapore. The company is based in Hong Kong, and the article has been corrected accordingly.