The amount of energy Apple used in data centers it leases from third-party providers more than quadrupled over the last four years, going from about 38,550 MWh total in fiscal year 2012 to more than 180,200 MWh in fiscal 2016, according to the latest annual environmental responsibility report the company released this month. Leased footprint now consumes close to one-quarter of Apple’s total data center energy consumption.

Fiscal 2016 was the first year Apple started tracking its exact energy use in colocation facilities using meters and reporting it as part of the company’s global footprint in its environmental report, offering for the first time a glimpse into the scale of its leased capacity and how quickly that scale has increased over the years.

This rate of growth illustrates just how much hyper-scale cloud platforms still rely on leased data centers, despite also spending enormous sums on building out their own server farms around the world every year. In addition, Apple’s focus on energy supply of these third-party facilities is an example of the growing demand for colocation services powered by renewable energy, which many providers and their customers have been observing recently.

See also: Here's How Much Energy All US Data Centers Consume

More than 99 percent of energy powering its leased data centers came from renewable sources, Apple said in the report. All energy powering data centers the company owns and operates on its own comes from renewable sources, according to the company.

Apple started using leased data centers in a big way in 2012; before then, it relied almost exclusively on its own capacity. As Data Center Knowledge reported at the time, it signed one of its first major data center leases in 2011 with DuPont Fabros Technology -- a 2.3 MW deal in Silicon Valley. Its leased capacity has been growing by leaps and bounds since.

Apple’s newly released historical colocation energy use figures illustrate the trajectory (click chart to enlarge):

(Data source: Apple Environmental Responsibility Report 2017)

Companies like Apple, Facebook, Microsoft, Google, and Amazon all rely on leased data centers to expand the reach of their global networks in addition to building their own mega-server farms. Third-party providers enable them to move into hot new markets quickly or get into new markets whose future growth prospects are uncertain, making investment in big local construction projects too risky. The cloud giants also take small amounts of capacity in various colocation data centers around the world to cache content closer to their end users, which improves their application performance.

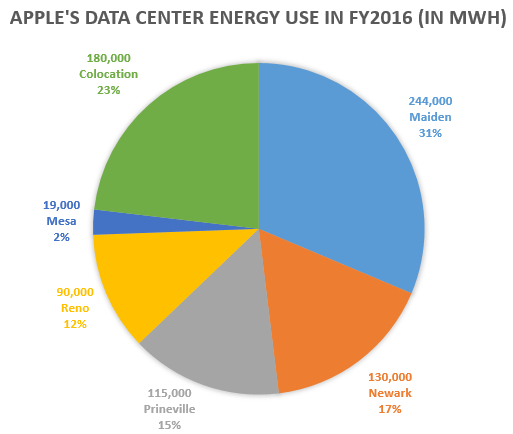

While its colocation footprint is growing, the bulk of Apple’s computing power still lives in data centers the company builds and operates on its own. Those data centers are in Maiden, North Carolina; Newark, California; Prineville, Oregon; Reno, Nevada; and Mesa, Arizona. New Apple data centers are under construction in Viborg, Denmark, and Athenry, Ireland.

Together, its live data centers, including both owned and leased (colocation) facilities, consumed about 780,000 megawatt-hours of energy in fiscal 2016 (Click chart to enlarge):

(Data source: Apple Environmental Responsibility Report 2017)

Leasing a lot of capacity around the world makes the cloud giants’ goals of reaching 100 percent renewable energy supply for their operations harder to meet. Colocation providers have to take all their customers’ needs into consideration, as well as their own interests, factors that often lead them to build data centers in places where clean power is not easily obtainable or not obtainable at rates that work for their bottom line.

But since more and more companies want third-party data centers that use renewable energy, and since the cost of renewable energy has come down in recent years, more and more data center providers have been willing to make the extra investment required to help their clients meet their sustainability goals.

For example, Infomart Data Centers, which serves hyper-scale customers (including LinkedIn), this year started buying renewable energy to power its entire Silicon Valley data center campus. The price premium for renewables, the company said, is about 6 percent more than the “higher-carbon alternative.”

Had it done the deal a few years earlier, it would’ve had to pay a lot more. “We could’ve cut this deal five years ago; the price premium would’ve been higher,” John Sheputis, Infomart president, told DCK in an interview. Today, “the premium to be all green is acceptable.”

Data center providers that recently made big investments in renewables also include Equinix, Digital Realty Trust, and Switch, among others.

Results of a colocation user survey Data Center Knowledge conducted last year showed a clear uptick in interest in third-party data center services powered by renewable energy. (Read more: How Renewable Energy is Changing the Data Center Market)