Data center REITs continue to report solid earnings and robust leasing activity. So, why has Mr. Market sold-off the entire sector during the past few weeks? What has changed between all-time highs in July, and the most recent quarter ended Sept 30, 2016?

The short answer is that REIT share prices tend to fall in a rising interest rate environment. Investors are concerned that a hawkish Fed may not be "one and done," and a December rate hike just might become a new trend for 2017.

However, Wall Street also hates uncertainty. The two U.S. presidential candidates have proposed distinctly different policies regarding the U.S. economy, taxation, global trade and energy policy.

Market Jitters

If you have been feeling anxious regarding your investment portfolio -- including your data center REIT shares -- you are not alone.

On Friday, Bloomberg reported that US stocks posted their longest losing streak in 36 years, as anxiety surges over the presidential election. The S&P 500 Index has lost 3.1 percent of its value over the past nine sessions.

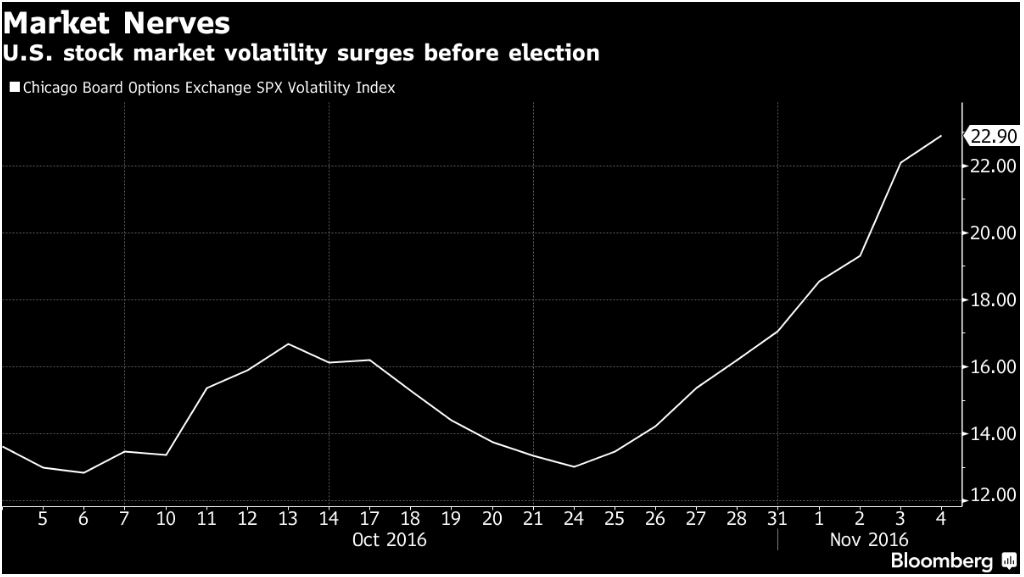

Source: Bloomberg.com

The Chicago Board Options Exchange (CBOE) SPX Volatility Index has spiked up to 22.90 over the same time period.

Since it is difficult to fight the proverbial ticker tape real estate investment trusts have seen valuations fall across the board.

Frothy REIT Valuations

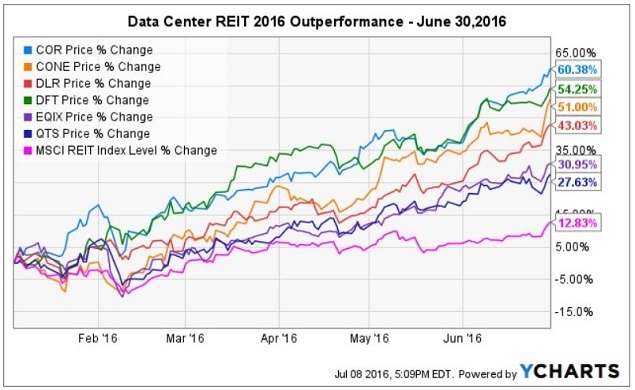

During the first half of 2016, share prices for the six data center REITs were bid up 50 percent on average, as shown on the chart below.

Source: YChart created by author

The highest flying REIT sectors have all been hit particularly hard by this recent sell-off. This includes regional malls, net-lease, multifamily, and industrial REITs -- with data centers prominently featured, at the very top of that list.

A tremendous amount of good news was baked into the June 30, 2016 share prices -- perhaps prematurely, due to record second quarter results.

Read more: Record Second-Quarter Leasing Fuels Data Center Land Rush

Then in early July, fears swirling around the Brexit vote took US REIT shares even higher.

Post-Brexit Price Boost

Data center REITs which had already been trading at frothy multiples, had prices kicked up another notch because they are levered to exponential data growth, and less dependent upon GDP, jobs growth and consumer confidence than more traditional REIT sectors.

This defensive aspect of US-based data center REITs has made them even more sought after by investors post-Brexit, including global connectivity leader Equinix and industry blue-chip Digital Realty, which both own significant UK and European assets.

Read more: Report: Data Center Market Trends ‘Strong Demand, Smart Growth’

By July 10, some data center REITs were priced higher than 26x earnings, (FFO or AFFO is used for REITs), versus a more normal trading range of 12x to 18x core FFO per share. This last leg-up resulted in the entire sector trading at all-time highs.

Tale Of The Tape - Prior To Election

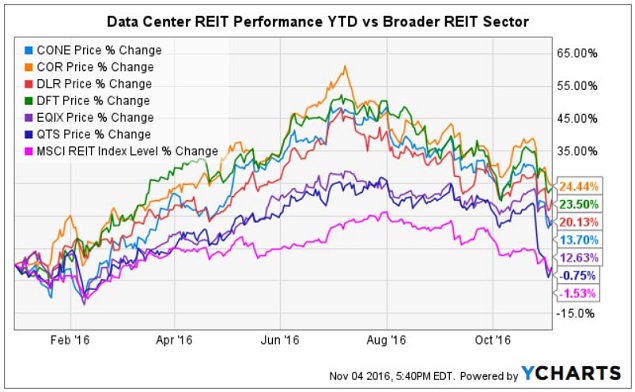

Fast-forward to November 4, just two trading days until the election results are known.

All six data center REITs have now reported decent-to-good Q3 2016 earnings. However, due to the rising wave of fear, good news is no longer good enough to sustain high multiples. It would have taken phenomenal news to overcome investor concerns regarding interest rates and the upcoming election.

In the face of uncertainty, data center REIT prices have pulled back and Price to FFO per share multiples have compressed. In turn, this has created a better value proposition for investors looking to initiate or add to an existing position.

Source: YChart created by author

The "growthy" data center REITs continue to outperform the broader REIT sector, but data centers are only up 15.6 percent on average year-to-date. However, that still beats the stuffing out of the S&P 500, NASDAQ 100, and DOW 30 indices, trading up 2.34, 1.64 and 2.75 percent, respectively.

Here is the sector at a glance as of Nov. 3, 2016 by market cap, Price to FFO, and yield:

- Equinix, Inc. (EQIX) - $24.1B, 23.25x FFO, 2.05% yield.

- Digital Realty (DLR) - $14.3B, 15.0x FFO, 3.97% yield.

- CoreSite Realty (COR) - $3.6B, 17.4x FFO, 3.00% yield.

- CyrusOne (CONE) - $3.5B, 15.0x FFO, 3.61% yield.

- DuPont Fabros (DFT) - $3.5B, 12.8x FFO, 4.81% yield.

- QTS Realty (QTS) - $2.1B, 16.0x FFO, 3.28% yield.

Notably, investors are still expecting faster growth from interconnection-focused Equinix and CoreSite. CoreSite also retains a bit of an investor halo from having been the top performing REIT in 2015 -- having delivered a total return of 50 percent.

Why Good News Doesn't Matter

I read the Q3 earnings prints, looked through the presentations, and listened to the earnings calls. While some were better than others, none were even close to being horrible enough to attempt to explain the rout in the market. The recent steep declines were predominately about valuation.

Frankly, there is little to be gained from looking closely at the operating results this quarter, because record lease signings, mid-teen ROIC on newly deployed capital, and robust future deal pipelines are simply falling on deaf ears.

Read more: CyrusOne Q3 Earnings – Trick or Treat?

Hopefully, after the election results are tallied and digested, FY 2016 results and 2017 guidance will be what investors focus upon, once again.

Investor Takeaway

Right now Mr. Market is viewing the entire equity REIT sector through gloom-and-doom colored glasses.

Data center REITs have simply pulled back to more realistic valuations. They are certainly still not "cheap" by traditional REIT standards, nor should they be. However, data center REIT investors still have a unique challenge to deal with next year. The success enjoyed during the past few quarters has created much tougher year-over-year comparisons for 2017.

This is compounded by the nagging concern that nobody knows how long the hyperscale cloud land grab will last.

Read more: Cloud Fuels Unprecedented Data Center Boom in Northern Virginia

Demand for space in the Silicon Valley, Chicago, the Pacific Northwest, and especially Northern Virginias has totally blown away historical averages. Nobody in the industry has a crystal ball to determine if this is a one-off, or the new normal.

However, the sky is certainly not falling. Not even close. Data continues to grow at exponential rates, driven by wireless data, streaming video, big data, cloud computing, and a still-nascent Internet of Things (IoT).

Technology sector investors are better able to understand the strong secular trends behind the recent acceleration in data center leasing. However, it is more challenging to educate "nervous REIT investors" who draw on experience with other sectors and past real estate cycles.

Notably, when there is a sea of red on Wall Street, it can be an excellent time to buy. Legendary investor Warren Buffett is often quoted as a reminder to investors: "Be greedy when others are fearful, and fearful when others are greedy."