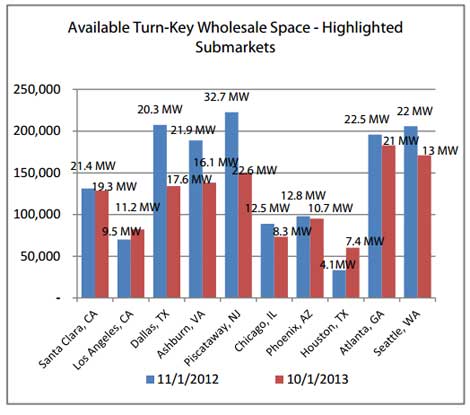

Real estate firm Avison Young reports that strong demand has reduced the inventory of wholesale data center space, as shown in this year-to-year comparison of inventory in key markets. (Graphic: Avison Young)

Data center developers have leased more than 500,000 square feet of turn-key "wholesale" space in 2013, shrinking the supply of available space in key markets, according to new data from real estate firm Avison Young.

"Year over year wholesale leasing activity is up over 50 percent, with significant transactions still in the pipeline," the firm notes in its October 2013 market analysis. "Chicago, Dallas and Northern Virginia are leading the U.S. in wholesale leasing this year."

The Chicago market appears to have the tightest supply, with just 8.3 megawatts of turn-key wholesale space available, compared to inventory of 17 megawatts in Dallas and 16 megawatts in Ashburn, Virginia, according to Avison Young.

Am emerging trend is the tendency for "super wholesale" customers to structure deals including space in multiple markets. The super wholesale category includes users with large Internet infrastructures who used to build their own data centers, but are now looking to lease plug-n-play space from developers. Facebook and Rackspace have historically been major players in the super wholesale game, but in the past year Microsoft and LinkedIn have become the marquee customers in this market, Avison reports, "and they are not finished leasing wholesale space."

Avison Young's Jim Kerrigan says he's seeing creative lease structures in which wholesale providers are offering tenants the option of shifting capacity from one location to another during a contract. Several large providers are competing head-to-head on multi-market transactions, Avison said.

The other key trend is the continuing blurring between "retail" colocation space and wholesale data center leasing, a trend we've been tracking for several years at DCK. Wholesale providers are targeting smaller deals that traditionally have been prime candidates for colocation, while more colo providers are offering wholesale-style data suites in addition to cabinets and cages.

"Data center operators providing solely wholesale or colocation are a thing of the past," Avison writes in its analysis.

In the past year, Digital Realty has expanded its colocation business, while Fortune Data Centers has offered a "Rack Ready" product designed to make wholesale space more accessible to colocation customers. Meanwhile, colocation provider RagingWire has entered the wholesale market.