The boom that started last year in the top four European data center markets -- when companies leased a record amount of capacity -- has extended into this year, according to the first-quarter market report by the research arm of the commercial real estate firm CBRE.

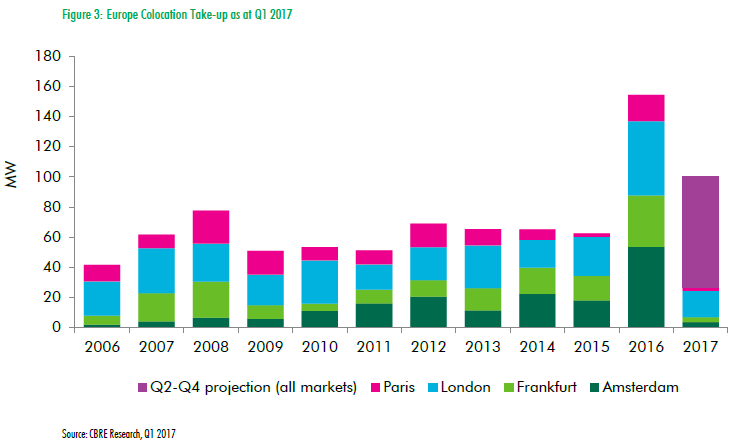

And London continues to lead, with more capacity leased in Q1 than in any of the other three markets tracked by the firm’s analysts – Frankfurt, Amsterdam, and Paris:

“London was responsible for the majority of take-up activity with 17.5MW of IT power transacted in the UK capital during Q1. A significant portion of this was a continuation of the wave of demand that swept through Europe last year.”

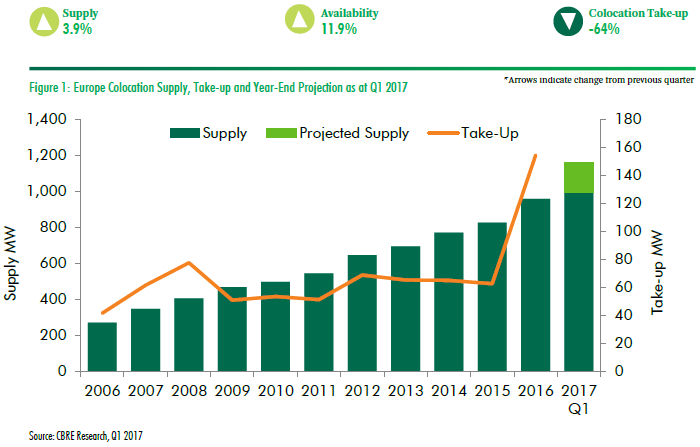

After a period of relatively slow take-up that followed the 2008 financial crisis, leasing across the four markets picked up somewhat in 2012, but remained essentially flat before a massive spike last year. The markets went from about 60MW of capacity absorbed in 2015 to close to 160MW in 2016, according to CBRE (click chart to enlarge):

There’s never been a year when companies leased more than 80MW of data center capacity across those four European data center markets before last year, the analysts said.

It’s also becoming increasingly clear that Brexit has had no negative effect on data center providers in London. CBRE has not seen a decrease in demand in London since activation of Article 50, the official mechanism that in March put the process of severing Britain from the European Union in motion.

Digital Realty Trust, the San Francisco-based data center REIT with substantial London operations, has observed the opposite. “Our order book in London picked up post-Brexit,” Digital Realty CEO, Bill Stein, said in an interview with Data Center Knowledge. “Maybe because the uncertainty has been resolved.”

The demand has come particularly from hyper-scale cloud providers, Stein added.

See also: Brexit Doesn't Stop Microsoft from Launching UK Data Centers

As companies that provide the physical infrastructure that stores, processes, and distributes digital content prepare for a potential scenario where the UK will have a different set of data sovereignty and transfer laws from those of the EU, they need physical presence in both, since it may become difficult if not impossible to serve customers in London from a data center in Amsterdam, for example.

Clients are increasingly choosing a dual-location strategy for their European data center footprint, which usually consists of a site in London and a second side in one of the other European markets, Stein said. “It could be that they’re hedging their bets,” he speculated.