Four of the six data center REITs have their first-quarter earnings, and the results have been impressive after disappointing Q4 2016 leasing results in many US Tier 1 markets.

This past quarter, Digital Realty Trust chalked up sales 20 percent higher than its $40 million per quarter historical average; DuPont Fabros Technology continues to beat its own records when it comes to hyperscale pre-leasing and backlog for large-scale deployments; and CoreSite Realty continues to put up impressive earnings, with first-quarter results 34 percent higher than the same period last year.

Notably, both wholesale leasing pure-play DuPont Fabros and connectivity-focused CoreSite have had to step on the gas to accelerate their development programs.

DuPont Fabros

The "new normal" for this data center REIT this year so far looks a lot like 2016 – also a record leasing year for the 100 percent wholesale landlord. DuPont Fabros year-to-date has leased about 35 MW, including a combined 28.8 MW of leasing to one existing customer in Chicago and ACC9 Phases I and II.

CEO Chris Eldredge shared on the earnings call last week that hyper-scale leases signed in 2017 were all with its third-largest customer, an "investment grade Fortune 25 company." Since Microsoft is DuPont's top customer, these deals were likely signed with Apple, an existing large customer.

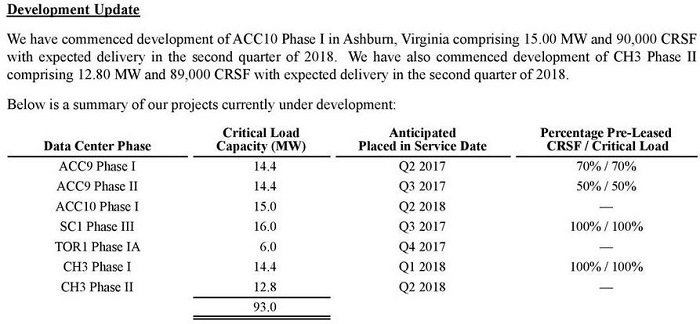

In fact, pre-leasing was so strong for DuPont in Ashburn, Virginia, and Chicago markets, it is accelerating its development plan for full-year 2017.

Source: DuPont Fabros – Q1'17 Supplemental (click image to enlarge)

CapEx guidance for full-year 2017 was raised to $725M-$775M from $575M-$625M, which includes acceleration of ACC10 and CH3 Phase II, as well as pre-development and design efforts in Hillsboro, Oregon (POR1).

CFO Jeff Foster said on the call that he has modeled a $300 million equity raise in conjunction with the accelerated development plan. Notably, the financial terms of these hyper-scale leases were consistent with the company's targeted 11-13 percent return on invested capital, or ROIC.

Eldredge felt confident that the 40 MW of Facebook leases coming due over the next couple of years in Ashburn would be re-signed. He said on the call, "We have very low churn, in part because our facilities attract sticky infrastructure from clients, including network nodes, test and development environments, and production environments."

CoreSite Realty

CoreSite's connectivity-focused retail colocation business model continues to rack up the impressive year-over-year metrics that matter to investors.

Q1 2017 highlights include:

- Revenues of $114.9 million, representing a 24.3 percent increase YoY

- Net income per share of $0.48, representing 29.7 percent growth YoY

- FFO (funds from operations) of $1.13 per share, representing 31.4 percent growth YoY

This ability for CoreSite to consistently deliver eye-popping double-digit FFO/share growth has attracted the attention of REIT investors, and continues to power COR shares to new all-time highs.

CoreSite has contracted to purchase two acres in Santa Clara, which will be redeveloped into SV-8, a multistory 160,000-square foot data center with 18 MW of critical power at full build-out. This addressed the concern of running low on inventory in Silicon Valley with only 81,000 square feet remaining to lease in SV-7. High utilization rate across the CoreSite portfolio has helped to make the company the top-performing REIT (of any sector) in 2015, as well as the top performer for the past three years.

CEO Paul Szurek and his team are also stepping on the gas in Northern Virginia. CoreSite has commenced construction of a 3 MW Phase 1 in Reston (a 25,000-square foot data hall in an existing industrial building to be delivered Q4 2017). The next phase will be the new 6 MW data center and central utility plant building with completion expected by Q2 2018.

Digital Realty

Digital's initial results for Q1 were impressive, as the landlord inked $50 million in aggregate sales volume, compared with a historical average of $40 million per quarter.

Q1 2017 highlights included:

- Large-scale deployments totaling $30.5 million

- Colocation 38,557 square feet for $10.5 million

- Interconnection contributed another $8.6 million

Digital plans to expand its Service Exchange offering from eight existing locations to 17 by year-end 2017, in addition to providing "layer 3 capabilities" to allow customers to self-provision SaaS providers.

The Digital slide-deck noted an uptick of new supply, while pointing out that in primary markets "demand outpaces supply." However, the call took on a cautionary tone when CEO Bill Stein emphasized that "the scars from the last cycle were still fresh."

Under the watch of recently hired global sales and marketing leader, senior VP Dan Papes, Digital Realty has reorganized its go-to-market strategy into three areas of focus: global, colo, and network. This move is part of a reorganization where the former Telx sales team and the business development team from eight Equinix/Telecity assets in UK and Europe have now been integrated into Digital Realty's global sales force. This restructuring was described as "customer-centric," aligning Digital's sales team more closely with how customers procure data center space.

Equinix

Today, Equinix announced that it had closed on its $3.6 billion Verizon America's data center acquisition.

This mammoth M&A deal has overshadowed solid Q1 2017 results for the global interconnection giant. In addition to 29 data centers, Equinix has added over 600 new customer logos and 250 former Verizon data center employees.

Read more: Done Deal: Equinix Closes $3.6B Verizon Data Center Acquisition

Disclaimer: Bill Stoller's REITs 4 Alpha Seeking Alpha Marketplace portfolio includes: COR, CONE and DFT. A member of his household in a retirement account owns: COR, CONE and DFT.