If you work around data centers every day, things like exponential growth of data, hybrid cloud, and the growth in outsourcing to third-party data center operators are old news.

But the large publicly traded Real Estate Investment Trusts that own and operate big fleets of wholesale and retail data centers are just beginning to develop a broader audience on Wall Street, and data center stocks are getting more and more investor attention.

Back in October 2013, San Francisco-based data center REIT Digital Realty Trust (DLR) was a trail blazer when it entered into an 80/20 joint venture valued at $366 million, or $346 per square foot, with a Prudential Financial real estate fund. PREI senior portfolio manager Cathy Marcus said at the time, "The long lease terms and contractual rental rate increases on these Powered Base Building data centers provide a stable income stream..."

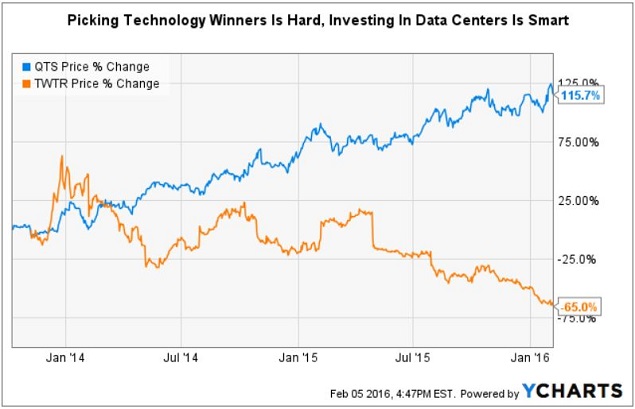

One week later, shares of QTS Realty Trust (QTS) debuted on the New York Stock Exchange. Twitter started trading on NYSE one month later. Today, Twitter shares are trading 65 percent lower than their IPO price, while QTS has more than doubled its share value and paid a tidy cash dividend each quarter since that week.

Click chart to enlarge

New Spotlight for Data Center Providers

Previously, strong performance of data center stocks like QTS and DLR was obscured by being lumped into Diversified, Office, or Industrial classifications. It was easy for investors to glance at a NAREIT (National Association of Real Estate Investment Trusts) table and see that self-storage REITs were performing well and the Lodging REITs were in a significant decline in November 2015.

FTSE and NAREIT started reporting the six publicly traded data center REITs (Equinix, CoreSite Realty Corp., Digital Realty, DuPont Fabros Technology, QTS Realty Trust, and CyrusOne) as a separate sector for the first time in December 2015, signaling that the sector has finally come of age.

Formal REIT approval last year for Equinix (EQIX), an S&P 500 company with an $18 billion dollar market cap, may have been helpful in achieving this recognition.

What investors could not see at a glance was that total returns by data center REITs for 2015 averaged 32.48 percent on an equal-weight basis. The playing field has now been leveled for 2016 and beyond.

Read more: JP Morgan: Data Center REIT Stocks Undervalued

Investors should realize that while data centers are a strong REIT sector, they are certainly not bulletproof. The six data center stocks are not immune to broader market and technology sector sell-offs, and the sharp drop in stock values the overall tech sector has been experiencing since last week has had a negative impact on all the major data center providers.

Why Invest in REITs?

Many investors look to diversify their portfolio beyond cash, stocks, and bonds by including alternative assets like real estate. Historically, equity REITs that own and operate trophy commercial real estate assets have outperformed many other investments.

Source: NAREIT December 2015. Click chart to enlarge

Publicly traded REITs are fairly easy to understand. In return for getting a pass on paying corporate taxes, REITs must pay out at least 90 percent of taxable income to shareholders in dividend distributions.

While non-traded REITs do exist, there are few reasons for most investors to own them. Publicly traded REITs provide investors with daily liquidity and transparency through mandatory SEC and stock exchange reporting.

Why Invest in Data Center REITs?

Data centers sit squarely at the intersection of real estate and technology. The secular trends of cloud computing, Big Data, and Internet of Things are tailwinds for both wholesale- and retail-focused data center REITs.

However, data center stocks like DLR, EQIX, or COR (CoreSite) are a very different investment than other tech stocks. Rather than placing a bet on IBM, Microsoft, Rackspace, Oracle, Google, or Amazon, you are betting on the landlords that own and operate a lot of those companies' data center real estate.

Read more: Who Leased the Most Data Center Space in 2015?

Third-party data center providers run the gamut, from selling just space and power to providing colocation, interconnection, cloud, managed services, and facility outsourcing. They serve tech companies as well as large enterprises, who outsource to them so they can allocate capital to core business initiatives.

A New Home for Equity REITs in 2016

Later this year the investment spotlight is going to be shining brightly on institutional quality real estate, including data centers. Equity REITs, which own and operate property, will be joining a newly created GICS top level Real Estate Sector. GICS stands for Global Industry Classification Standard.

Source: MSCI

Real Estate will become the eleventh GICS sector at the close of trading on August 31, 2016. This means that there will be a lot of rebalancing in index funds and ETFs, and likely there will be new real estate investment products offered as well.

Mortgage REITs that own and trade securities and derivatives will remain in Financials, along with commercial banks and insurance companies.

Read more: US Data Center REITs Enjoying a Booming Market

REIT ETFs: a Simple Strategy

An easy way to gain exposure to US REIT stocks, including data center stock, is buying ETF shares.

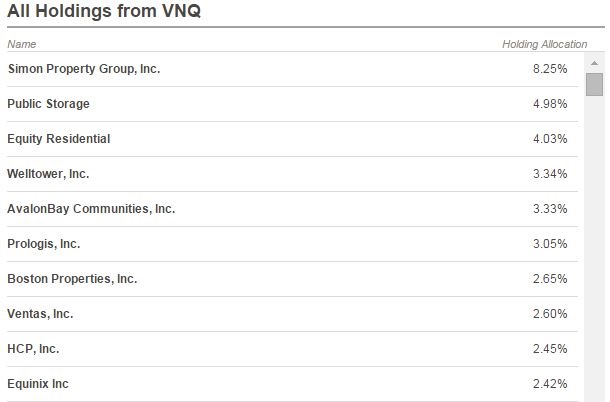

The Vanguard REIT Index ETF (VNQ) is a simple way to own a basket of RETs across all of the sectors, including office, retail, industrial, apartments, self-storage, and hotels. The VNQ is the largest ETF by market cap. This REIT ETF closely tracks the MSCI REIT Index (RMZ), while only charging a 0.12 percent fee.

It is important to realize that the top four REIT exchange traded funds are all market-cap weighted. That means the Top 10 holdings can dominate performance, in a similar fashion that large-cap tech stocks heavily impact the NASDAQ 100 performance.

Notably, mall giant Simon Property Group, which has a $58 billion market cap, is the largest VNQ holding at 8.25 percent.

Source: etf.com February 2015. Click to enlarge

The "Big 3" healthcare REITs Welltower, Ventas and HCP, Inc. are all included. There are two large multifamily REITs, one self-storage giant, an office REIT, a global industrial REIT, and now Equinix joins the list.

In the aggregate, these Top 10 REITs represent a 37.1 percent weighting, out of a total of number of 153 REIT holdings. If you don’t happen to like the prospects for malls, CBD offices, and healthcare real estate, you might want to consider another strategy.

Smart Beta Data Center Sector ETF Strategy

If you are a regular Data Center Knowledge reader, you may already have an ownership interest in a private company or own shares in a publicly traded employer. Investing in a basket of REITs is a way to diversify while maintaining an overweight exposure to the data center sector.

In a January Seeking Alpha article, I suggested a strategy of simply creating an equal-weight portfolio of the six data center REITs. Investors need to take a DIY approach because there is not an ETF investment product "on the shelf" just focused on data centers.

My bullish data center thesis concluded that a "DIY Smart Beta ETF" will outperform the broader equity REIT sector (RMZ) in 2016. The bonus for investors was my suggestion that this simple strategy would also outperform the S&P 500. In January, the six data center stocks were up 6.48 percent vs a loss of 3.6 percent for the S&P 500.

During February, the data center REIT spotlight will be on Q4 2015 earnings and initial guidance for 2016.